With the rather volatile action in global equities over the past few weeks, it’s worth checking in on where market breadth is tracking. We take a unique approach in breadth analysis for global equities in that we look across a country-level rather than individual stock level. The benefit of this is that you can pickup early warning signs e.g. as certain groups of countries start to come under pressure e.g. as a result of some underlying macro issues. Aside from warning signs and risk management, it can also be useful in identifying opportunities, and this is well highlighted in today’s blog.

The key conclusions and observations are:

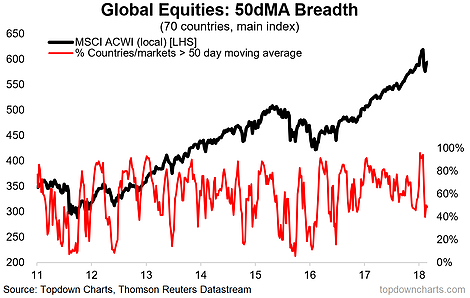

1. 50-day Moving Average Breadth: 50DMA breadth for global equities (across 70 countries) collapsed to oversold levels in the wake of the stockmarket correction (which sent the MSCI All Countries World Index in local currency terms down just over -8% top to bottom), and has since rebounded – usually a bullish signal. Interestingly this comes off the back of a classic bearish divergence which was initially resolved through a blow-off top.

2. “Death Cross” Breadth: The “Death Watch” chart tracks the breadth of so-called “death crosses” across the 70 countries we monitor. A Death Cross is when the 50-day moving average passes below the 200-day moving average, and often occurs around a major turning point. This indicator had been tracking upwards prior to the correction (another bearish divergence), yet has tapered off – indicating low levels of underlying weakness. This indicator can serve as an early earning when e.g. a particular issue or set of issues is causing a group of countries to see weakness in their equity markets.

Leave A Comment