High-income countries vary considerably in the share of households that own their own homes, The US rate of homeownership was about average by international standards 20-25 years ago, but now is below the average. Here are some facts from Laurie S. Goodman and Christopher Mayer, “Homeownership and the American Dream” in the Winter 2018 issue of Journal of Economic Perspectives (32:1, pp. 31-58).

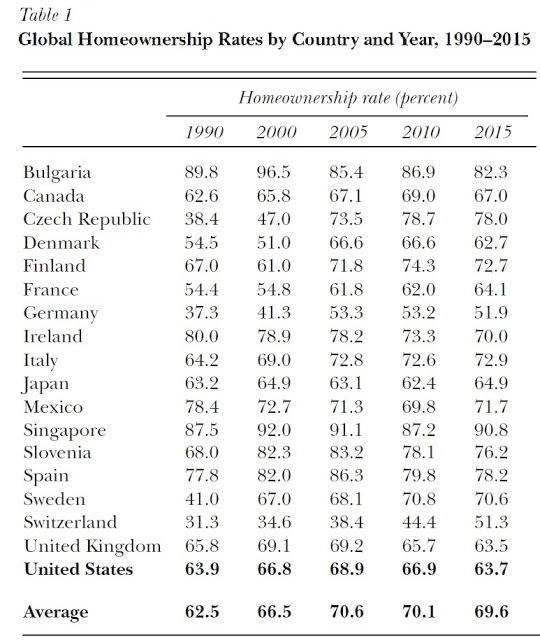

“The United States does not rank particularly high among other high-income countries when it comes to homeownership. Table 1 compares the homeownership rate from 1990 to 2015 across 18 countries where we have been able to obtain somewhat comparable data over the entire time period. The United States was ranked tenth in 1990, at the middle of the pack and close to the mean rate. By 2015, the United States was the fifth-lowest, its homeownership rate of 63.7 percent falling well below the 18-country average of 69.6 percent. Over the 1990–2015 period,13 of the 18 countries increased their homeownership rates. The five countries with declines in homeownership were Bulgaria, Ireland, Mexico, the United Kingdom—and the United States.

“In a broader sample of countries, many of which have missing data for some of the years in question, the United States homeownership rate in 1990 was slightly below the median and mean of the 26 countries reporting data. By 2015, the US ranked 35 of 44 countries with reliable data, and was almost 10 percentage points below the mean homeownership rate of 73.9 percent.”

There are a lot of possible reasons for this variation, including “culture, demographics, policies, housing finance systems, and, in some cases, a past history of political instability that favors homeownership.” They offer an interesting comparison of how homeownership rates in the UK and Germany evolved after World War II (citations and footnotes omitted):

Leave A Comment