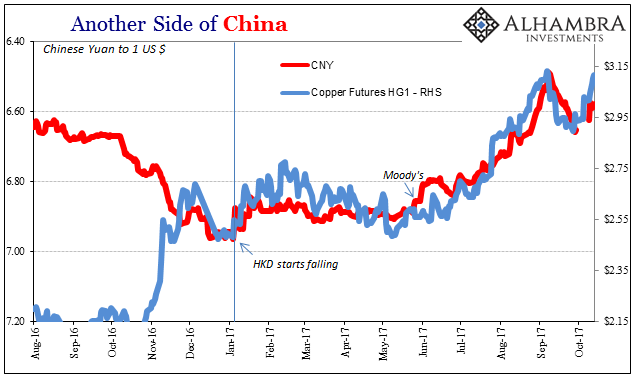

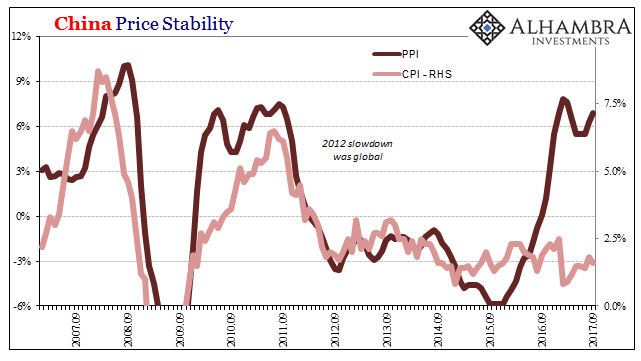

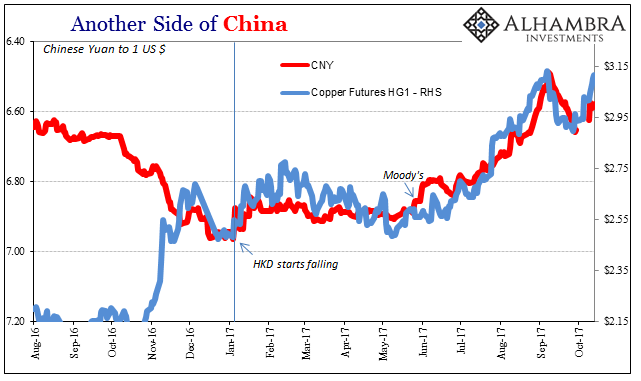

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence from other industrial metals like copper and iron.

Where the Chinese PPI is being boosted by these market shifts, consumer prices are not. It suggests the same disparity between those raw market prices and those ultimately yielded by later economic processes. China’s CPI registered only 1.6% growth year-over-year in September, down from 1.8% in August and 2.5% back in January 2017. The government has mandated for this year, as is usual, a 3% CPI rate as its definition of “price stability.”

This disparity suggests the difficulties for industrial firms in passing along price increases to customers (weak end demand). Chinese industrial profits are up and have been since last year, but that increase is due to these price effects bolstering the resource sector over and above the price squeeze occurring in the manufacturing sector.

Because the global economy has not rebounded all that much, either, Chinese manufacturers are left without the possibility of passing off some of that PPI to global customers in the US and in Europe. It’s as if these industrial metals prices are in some ways detached (fears over pollution controls, for one) from economic fundamentals.

As noted last week, US inflation remains suspiciously subdued, as well. No matter how much any one central bank does (or does not), consumer prices have largely ignored those efforts. The PBOC has contributed since the start of 2016 to those energies in RMB terms. That the outcome is the same for Chinese consumer prices as US consumer prices again reflects global money as opposed to local central bank theory and experiment.

Leave A Comment