While world stocks are on their longest streak (without a 5% correction) in history, the last few weeks have seen that exuberance accelerate with MSCI World now at its most ‘overbought’ since the summer of 1987… and we know what happened next.

But this global euphoria is ‘trumped’ by the melt-up in US stocks, and as Bloomberg reports, John Murphy, StockCharts.com’s chief technical analyst, warns U.S. stocks have shown so much momentum lately “that 2018 may not end as well as it started.”

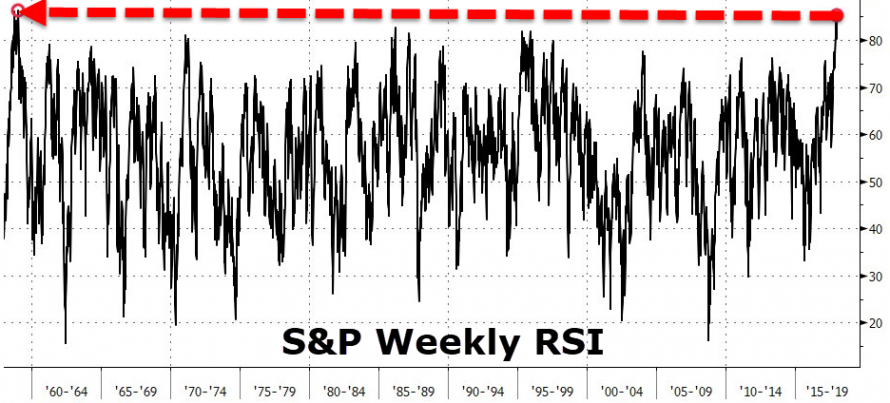

Murphy cited 14-week and 14-month relative strength indexes for the S&P 500 Index in a blog posting Saturday.

Data compiled by Bloomberg shows the weekly RSI, displayed in the chart, closed Friday at 85.27 — the highest since January 1959.

The monthly RSI ended last week at 86.07, above every month-end reading since June 1996.

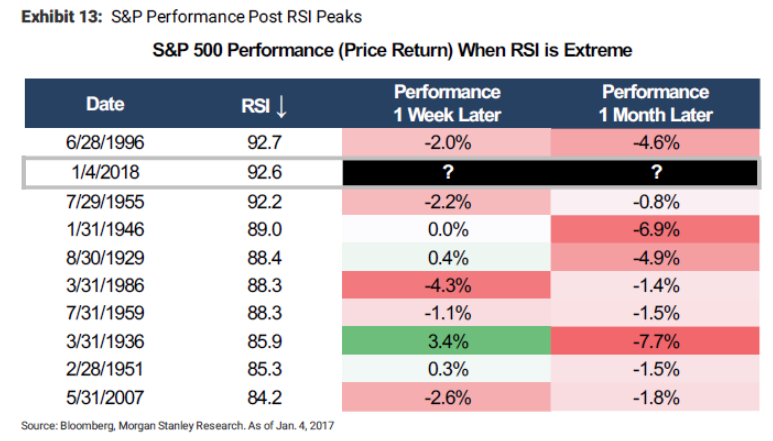

And as Morgan Stanely notes, these extremes of relative strength do not end well.

In the past, when the RSI has peaked above 80 an average correction of -3.5% has followed one month later.

The corrections have ranged from -0.8% to -7.7% (Exhibit below).

In our view, a pullback feels close and it is now just a matter of time. We would be buyers of that pullback but think it is prudent for investors who are looking to add risk to wait at this point.

However, historical facts aside, JPMorgan disagrees that an extreme overbought signal is worrisome.

While a rally has pushed S&P 500’s relative strength index to levels not seen since the dot-com era, that alone is no evidence that a bubble is forming in the stock market, JPMorgan’s technical analyst Jason Hunter writes in a note.

And finally, as Bloomberg reports, euphoria on Wall Street that stocks can just keep on building on record highs is getting so stratospheric that it’s reaching levels that previously signaled a slump.

Analysts are ratcheting up their forecasts for U.S. corporate profits at the fastest pace in more than 10 years, according to the research firm Bespoke Investment Group. And that’s happening, unusually, right in the run-up to an earnings-season kick-off.

Leave A Comment