It is safe to say that nobody expected the BOJ stunner announced last night, when Kuroda announced that Japan would become the latest country to unleash negative interest rates, for one simple reason: Kuroda himself said Japan would not adopt negative rates just one week ago! However, a few BIS conference calls since then clearly changed the Japanese central banker’s mind and as we wrote, and as those who are just waking up are shocked to learn, negative rates are now a reality in Japan.

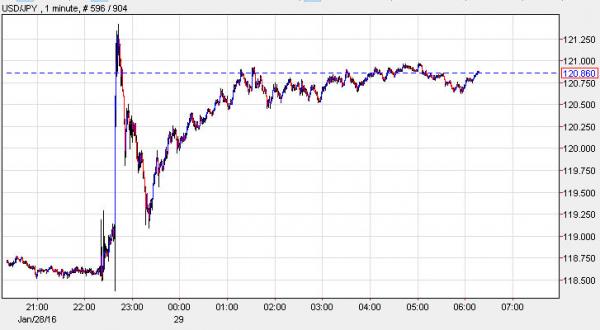

The immediate reaction was to send the USDJPY surging by nearly 200 pips, back to levels seen… well, about a month ago.

“The Bank of Japan gave markets a nice surprise to end the month,” said Heinz-Gerd Sonnenschein, a strategist at Deutsche Postbank AG in Bonn, Germany. “It’s a bit too early to say whether we’ll finally get that long-lasting rebound.”

Actually no it isn’t: it is virtually certain that the BOJ action will exacerbate global currency wars as it forces China to retaliate once more, in turn accelerating capital outflows from China, depressing asset prices and not only adding to global volatility but also depress both the Japanese and global recovery as we explained earlier.

Then again, central banks really have no choice at this point: they have to keep pushing or face systemic collapse. As SocGen’s Kit Jukes points out, whether or not it works matters less than fact that “disinflationary forces in the global economy are so entrenched” that central banks feel need to “set off on this path at all” He notes that one should “feed on the symbolism” as Germany, Switzerland and Japan, “three great current account powers of the post-Bretton Woods era,” are being told “in no uncertain terms to stop saving.”

However, for now the post-BOJ euphoria still lingers, but while stocks and bonds rallied around the world, the biggest impact was on the bond market where the yield on 10Y has tumbled to a just 1.92% as Japanese institutions will clearly be forced to buy even more US paper, in the process flattening the US curve – that all important recession signal – even more.

Curiously, the stock rally, which started off strong, has lost much of its earlier spark driven by the latest episodes in the Russian-OPEC “headline” fiasco, when this time the Russian energy minister Novak admitted he may have skewed reality a little yesterday, saying there was no confirmed meeting with OPEC or non-OPEC countries, adding Russia hasn’t begun internal discussions on how any cuts would work but that it is ready to at least discuss issue of output cuts, even if it is not ready for a decision. He concluded that coordinated cuts would only be possible after detailed talks.

In other words, all Russia did was conduct a trial balloon on reaction to oil supply cut headlines. The only problem is getting the Saudis on the same page.

The result is that after spiking another 2% in overnight trade, dropped into the red before rebounding modestly, which in turn is capping gains on US equity futures.

The focus on the US calendar will be the Q4 GDP print while we will also get the quarterly ECI and PCE readings. The January Chicago PMI and ISM Milwaukee are also due before the final revision to the January University of Michigan consumer sentiment print. It’s a quieter day for earnings reports with just 18 S&P 500 companies due to give their latest quarterlies, with Chevron (pre-market) the highlight of the bunch. We’re also due to get comments from the Fed’s Williams (due at 8.30pm GMT) – the first Fedspeak since the FOMC meeting this week.

Where markets stand now:

Asian equity markets traded higher following the gains on Wall St., where strong earnings coupled with a rally in crude boosted risk sentiment, while volatility was observed with the BoJ initially jolting markets after unexpectedly announcing negative rates. This saw volatile trade in the Nikkei 225 (+2.8%) while the ASX 200 (+0.6%) was supported by outperformance in energy names. Shanghai Comp (+3.1 %) outperformed after the PBoC announced to conduct OMO every working day around the new year holiday as it seeks to avoid a liquidity crunch while also today injecting CNY 80bIn via 28-day reverse repos and CNY 20bIn via 7-day reverse repos. 10yr JGBs soared by over a point as Japanese bond yields fell to record lows following the BoJ announcement of negative rates with tenure declining to as low as 0.09%

Asian Top News

Leave A Comment