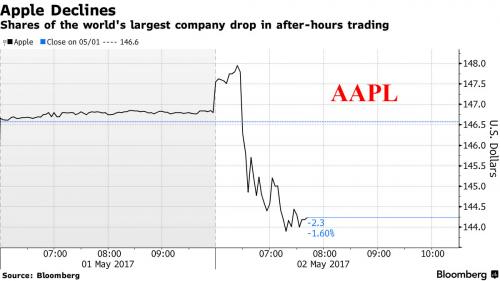

European, Asian stocks and S&P futures all fall as investors digested poor overnight news on Apple earnings and U.S. car sales, while the dollar rose in muted trading as investors contemplated chances of another rate hike next month ahead of today’s Federal Reserve statement.

Europe’s Stoxx 600 fell from a 20 month high as traders sold risk after poor earnings from Apple and a 4th consecutive month of declining U.S. car sales, while the dollar strengthened before a Federal Reserve meeting where policy makers will need to mull over another soft patch in the U.S. economy. European Apple suppliers were among the biggest losers in the broader Stoxx 600 Index, with Dialog Semiconductor dropping as much as 6.2% before recovering losses.

Poor April auto sales in turn hit industrial metals which pushed commodity producers for a third day. Falls in the price of copper, iron ore and other metals also underlined growing nerves over China and, with oil prices stuck near recent lows, weighed on Europe’s commodity-heavy indices.

“These numbers point to U.S. consumers becoming more cautious and do seem like a source of some of the weakness today,” said Andy Sullivan, a portfolio manager with GL Asset Management UK in London. “Autos, tech and basic resources are leading Europe lower.”

A bond rally in peripheral Europe was led by Italy while closed markets in Japan, South Korea and Hong Kong limited trading in Treasuries, which weakened at the start of European hours.

And then there is today’s Fed statement. As a reminder, markets now price in a 60% probability of a June rate hike, however weak U.S. economic numbers in the past month have cast some doubt on this. As a result, traders will be keenly looking at hints by Yellen whether the recent bout of economic weakness will be seen by the Fed as merely temporary.

According to DB, there is unlikely to be much new information in this month’s FOMC statement. DB’s Peter Hooper believes that the risk, albeit a small one, is that they will come closer to moving in a tightening direction than currently expected. More will be learned on that score in post-meeting Fedspeak (for which there are a number of speakers due on Friday including Fed Chair Yellen) or the minutes to the meeting. In terms of the finer details, Peter highlights that the Committee should be able to get away with relatively minor changes in the discussion of recent developments. They can acknowledge the soft GDP print and consumer spending in particular. That said they should also downplay this softness given the known issues with seasonality. On the inflation front, indicators have trended modestly higher on balance, notwithstanding a softening in core inflation in March driven by the anomalous drop in mobile phone services prices. The YoY change in the core PCE price index was running just modestly below the Committee’s 2% objective through Q1. An up-drift in most measures of wage inflation over the past couple of years confirm that the labor market has been in the vicinity of full employment for a while now. Market measures of inflation expectations have eased on balance since the March FOMC meeting, though they have rebounded recently. In summary, with market expectations for a June hike running at 67% according to Bloomberg’s calculator (and just 13% for a May hike) there will probably not be a need to push these expectations higher at this point. But any net changes in the statement are more likely to be read as hawkish rather than dovish, simply because the current and near-term prospective mix of economic developments probably moves them closer to their next rate hike, which DB expects will be in June

Back to markets, where after a mixed Asian session, with Japan, SKorea and HK closed, the MSCI global share index was marginally lower on the day. Satoshi Okagawa, senior global markets analyst for Sumitomo Mitsui Banking Corporation in Singapore, said the weak U.S. auto sales could make market participants wary of actively buying the dollar against the yen for now. “Concerns about geopolitical risks such as North Korea had weighed on the dollar against the yen recently … But the focus is shifting to whether the (strength) of U.S. economic fundamentals is for real,” he said. “There is more data coming up including the jobs data, so those need to be watched closely,” Okagawa said, referring to the U.S. nonfarm payrolls report due on Friday.

Euro Stoxx 600 fell 0.2 percent as of 10:37 a.m. in London, with losses led by miners; Futures on the Nasdaq 100 gained 0.1 percent. S&P 500 futures retreated 0.2% after the underlying gauge rose 0.1% Tuesday.

The Bloomberg Dollar Spot Index rose, reversing Tuesday’s fall, as traders covered some shorts in the currency even though options suggested the Federal Reserve policy decision will fail to excite markets. Bloomberg notes that amid low volumes and below-average liquidity with Japan closed for holidays, fast-money accounts were seen cutting part of their dollar-short positioning in the London session, according to foreign-exchange traders in the region. Investors expect marginal language shifts, if any, by the Fed and an unwillingness to commit to a June hike. Tier-one data out of the U.S. are to be released in the weeks ahead, including employment and inflation figures, which makes a case for policy makers to adopt a fully flexible approach. Options reflect subdued expectations on the Federal Open Market Committee decision and communique: overnight volatility in euro-dollar peaked earlier at 12.41 percent, the second-lowest reading on any announcement day since 2016

Leave A Comment