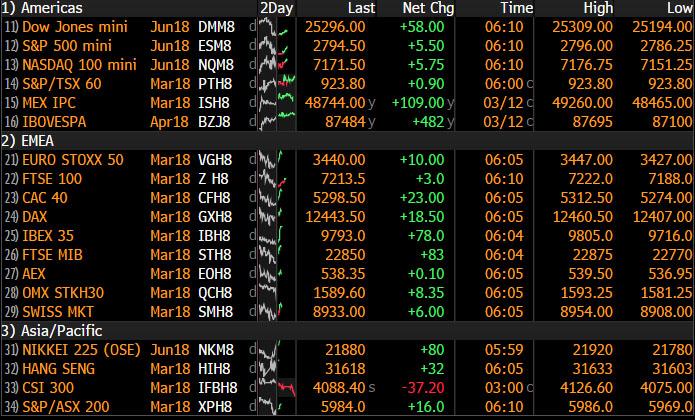

After yesterday’s aborted market liftoff, which saw the S&P spike at the open then fizzle lower amid easing trade tensions and a goldilocks US economy, today world stocks are going for it again, with European stocks climbing following a mostly green Asian session.

The MSCI All-Country World index of stocks was up less than 0.1%, and has recovered about half its losses from the February correction.

S&P futures were trading at session highs while the dollar strengthened with less than 90 minutes to go until the much anticipate U.S. inflation report which will provide more clues on the pace of Fed tightening. Treasury yields were fractionally higher as oil slipped.

It’s all about the CPI print today, and as Deutsche Bank notes, “will we see yields march up today or will the latest batch of US inflation data disappoint? We’ll know the answer to that with the release of the February CPI report in the US. As a reminder, market expectations for the data is for a +0.2% mom headline and core reading. Should we see that then the annual rate should nudge up one-tenth at the headline to +2.2% yoy while the core should hold at +1.8% yoy. One interesting point our colleagues make is that the annual growth rate of core CPI will mechanically rise by around 20bps in the March data release just from annualizing the -10% decline in wireless telephone services. In our economists’ view, this should help core CPI to exceed +2.0% yoy in March, before then rising further to +2.3% yoy by the end of this year.”

Others chimed in: “Today’s CPI inflation data is likely to add further color to the US inflation picture, however it probably won’t add any further clarity to the overall inflation outlook puzzle, given that the Fed doesn’t use CPI as its inflation benchmark,” Michael Hewson, chief markets analyst at CMC Markets in London, told Reuters. “Nonetheless it is still a useful gauge in establishing when and how the price pressures we’ve been seeing build up in US supply chains start to filter down into the wider economy.”

That said, while the CPI is closely watched by traders, it is not the primary gauge the Fed uses to determine whether it is meeting its mandate of price stability. Instead, the Fed uses the personal consumption expenditure (PCE) index, or as UBS’ Paul Donovan puts it:

US consumer price inflation is due. Markets focus on this price measure. It matters to inflation-linked US government bonds. The Federal Reserve does not focus on this price measure. A relatively large part of US consumer price inflation is prices people do not pay in the real world. These prices may start adding to inflation this year.

Back to markets where the Stoxx Europe 600 Index rose for a seventh day in Europe’s longest run since October, led by oil and mining shares. Italian and Spanish stocks rose 0.3 to 0.4 percent, while Britain’s FTSE was a laggard, down 0.1 percent, and in early trading triggered a “death cross.”

MSCI’s Asia-Pacific shares ex-Japan index rose 0.2% after spending much of the day swerving in and out of negative territory, and after surging 1.5% on Monday. Japanese stocks fluctuated before closing higher, while Hong Kong and Chinese shares slipped. The yen weakened as investors digested the political fallout from a scandal embroiling Japanese Finance Minister Taro Aso, and decided – for now – that it won’t rock the Abe administration materially.

However, both Asian and European trading has been muted, with modest volumes as most are waiting for U.S. CPI report. According to Bloomberg, a figure that misses or meets estimates is likely to reaffirm the case for just three rate hikes this year and give the green light to fresh appetite for risk assets.

Politics also remain in focus after President Donald Trump issued an unexpected executive order blocking Broadcom Ltd. from acquiring Qualcomm Inc., scuttling the $117 billion hostile takeover which would have been the biggest tech deal in history, and had been the subject of scrutiny over the deal’s threat to U.S. national security.

In FX, the Bloomberg Dollar Spot Index pared Monday’s drop ahead of the CPI reports as investors covered dollar-yen shorts after Aso refused to resign as part of the Moritomo scandal. Volatility remains in defensive mode with buyers yet to surface, while most major currencies stay in tight ranges in an overall quiet session. Pound traders stay sidelined, looking for headlines on Brexit and Hammond’s Spring Statement.

Overnight FX recap from Bloomberg:

“The broader story remains that of U.S. monetary policy normalization in the backdrop of an improving economy and a further decline in currency market volatility would only fuel more risk-taking appetite,” said Commerzbank’s FX strategist Thu Lan Nguyen.

The yen tends to suffer in an environment when riskier and higher-yielding assets are bid but Morgan Stanley strategists said in a note that a further deterioration in the political situation that affected the position of Abe, could see the yen“forcefully return towards its previous upward trend.”

Leave A Comment