S&P futures were little changed at 2,425, ignoring the N.Korea tensions of the past two days which will likely be a major topic in the upcoming G-20 summit, as European stocks fluctuate and Asian markets advance. Crude oil fell, snapping the longest winning streak this year, as Russia said it opposed any proposal to deepen OPEC-led production cuts.

Just like Tuesday, it was a session of two halves, with the Yen initially starting the day stronger as military tensions built up in Korean peninsula, and cash Treasuries breaking with a firmer tone as 10-year yield initially fell. Aussie reversed part of Tuesday’s losses despite a drop in Caixin PMI data, and Dalian iron ore 1.6% higher.

“North Korea has rattled markets but central bankers are more important,” said Kathleen Brooks, research director at City Index in London. “While North Korea’s military ambitions are a background threat for markets, we don’t think that this particular geopolitical event is at the stage yet where it will cause a spike in volatility.”

However as the session progressed, gold and the Japanese yen gave up early gains, with both the metal and the currency retreating. At the same time, MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 percent, regaining half the losses it saw on Tuesday when North Korea fired a missile into Japanese waters. South Korea’s main index rebounded by 0.36 percent and Japan’s Nikkei ended up 0.25 percent. Shanghai stocks rose more than 1 percent, despite a drop in the Caixin/Markit services purchasing managers’ index (PMI) to 51.6 in June, from 52.8 in May.

Of note in China is the continued aggressive tightening behind the scenes, with the People’s Bank of China refraining from offering funds in open-market operations for a ninth day, effectively draining more cash, in the past two weeks than it had injected from June 1 to June 19 amid quarter-end funding demand. The Chinese central bank has pulled 660b yuan since June 20, more than the 540b yuan it had injected from June 1 to June 19. The PBOC said there’s ample liquidity in the banking system, taking into account lenders’ reserve requirement payments and reverse-repo maturities. Sooner or later this latest tightening episode will hit risk assets and commodities, but not just yet.

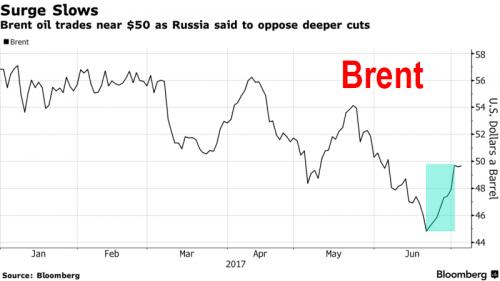

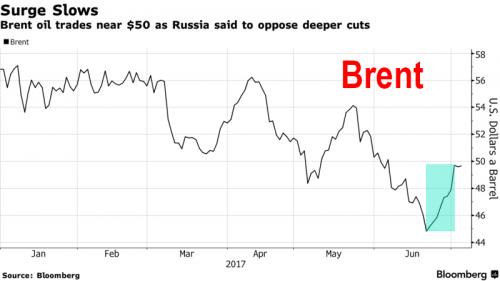

Meanwhile, the dollar rose as U.S. stock futures and Treasuries traded sideways before the FOMC Minutes release today. The euro dropped and European stocks edged higher amid a slew of services data, and as investors await Thursday’s publication of the latest ECB minutes. The return in risk sentiment helped USDJPY push higher through 113.60, the highest since May 16 as EUR/JPY breaks to another YTD high; EUR/USD briefly spiked lower after ECB’s Coeure says the ECB has not been discussing policy changes. Gilts underperform after hawkish commentary from BOE’s Saunders overnight and duration heavy corporate issuance, short-end leads gilt curve steeper. Crude futures sold off on OPEC production concerns and Russian comments (see below) mid-morning amid heavy volume.

European equity markets initially rally from the open, DAX outperforms after Adidas upgrade; gains later fade as oil and gas stocks weigh. The Stoxx Europe 600 Index gained less than 0.1 percent aftersurging 1.1 percent on Monday.Futures on the S&P 500 Index were little changed. The cash index rose 0.2% Monday in a shortened session before the July 4 holiday.

While aside from FX, there were little notable moves, oil futures dropped 1.7 percent in New York, snapping eight straight sessions of gains. Russia wants to continue with the current deal and any further supply curbs would send the wrong message to the market, according to government officials. The U.S. dollar gained, reducing the appeal of commodities denominated in that currency

While prices have surged during the past week, oil remains in a bear market after concerns that rising global supply will offset output cuts from OPEC and its partners. Libya and Nigeria, exempt from the OPEC-led curbs, accounted for half of the group’s production boost last month, according to data compiled by Bloomberg.

Focus now shifts to the key event on Wednesday, the latest Fed minutes. “The FOMC minutes will be the major macroeconomic highlight as the U.S. returns from the Independence Day break,” Ipek Ozkardeskaya, a market analyst at London Capital Group, wrote in a note. “Lack of details regarding the Fed’s balance sheet policy could further weigh on U.S. yields and the dollar.”

“The more interesting aspect of the minutes is going to be what they have to say about the balance sheet, and in particular, if they give any hints about the time frame,” said Stephen Stanley, chief economist at Amherst Pierpont Securities in New York.

Should the minutes refer to financial conditions, reiterating comments from Yellen, Fischer and Williams, the market will have to assume that the Fed may be willing to ignore the current inflation undershoot, leaving markets with very little other option than trading closer to the Fed’s own interest rate projections as expressed by the dots, Morgan Stanley strategists say in a note to clients.

A shift towards more hawkish language by several major central banks has dominated the past week and left markets unsure of how much longer emergency stimulus in Europe will continue to support global asset prices. For now investors seem to be giving policymakers the benefit of the doubt that the global economy can take any tightening of monetary policy, although the latest data on Wednesday was mixed – strong in Europe and weaker in China.

Leave A Comment