European stocks are modestly in the green as gains in banks and oil companies offset declines in miners. Asian stocks and S&P futures rise with Emerging-market stocks extending their longest winning streak since August on the back of the 5th consecutive daily drop in the USD.

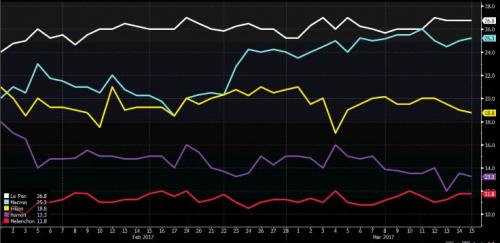

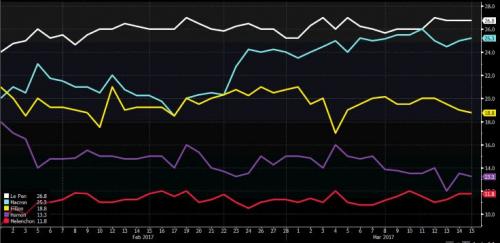

The euro rose to the strongest in six weeks after a French presidential debate eased market concerns about a possible Le Pen win: the first French debate was reportedly won by centrist Emmanuel Macron. For those who missed it, last night saw the first televised debate between the candidates. Those who tuned in may be feeling a little jaded as the debate ended up lasting a whopping three and a half hours. There were plenty of head to head moments between Macron and Le Pen in particular which included much finger pointing and also amusing bouts of sarcasm. Immigration was unsurprisingly a hot topic while the exchanges also moved over to the economy and various policy measures. The general feeling was certainly one of it being lively however. Markets were largely waiting for some sort of conclusion about who came out on top though and following the debate an Elabe poll (covering 1157 respondents) found that Macron was seen as the winner of the debate at 29% with Melenchon second with 20%. Fillon and Le Pen came in joint third at 19% and Hamon came in fifth at 11%. An Opinionway poll showed 25% for Macron; in both polls Fillon and Le Pen were tied at 19%.

“From the point of view of international investors, this is a positive as it keeps France’s position in the euro zone secure, or at least not weaker,” said DZ Bank analyst Rene Albrecht.

As a result, the average probability of Macron win implied from betting odds climbed 2ppts to over 63%…

… boosting the Euro and peripheral bonds while pressuring Bunds. It’s worth noting that there are another two debates to come prior to the first round election on April 23rd. It’s also worth noting that Hillary Clinton was seen as the comfortable winner in all the US Presidential debates.

Taking a cue from the debate polling which showed Macron as the most convincing, German bonds slid from the open, with French election risks seen waning. Losses extended in bunds after stronger-than-expected U.K. inflation data pressured gilts lower, with 10y U.K. yields climbing by around 6bps. MPC-dated SONIA rate jumps to price in almost one full hike by August 2018. The easing of French election risk has firmed rate-hike expectations for the ECB. Euribor strip has bear steepened from the open, with market pricing now showing over 20bps of rate increases priced by Sept. 2018.ECB rate expectations have seen the 5y sector on the German curve underperform, now cheaper by around 2bps on the 2s5s10s fly.French bonds meanwhile opened higher after the debate, with 10y yields dropping as much as 4bps. The move was quickly faded, as has been repeatedly observed in similar bouts of optimism around the French election. OATs now little changed.

The biggest winner, however, was the Euro, which rose to just shy of 1.08, the strongest in more than a month.

“When you consider how many people have been worried about this election and how cheap the euro is, if that risk were to go away then there’s the potential for money to flow into Europe,” said Andrew Sheets, chief cross-asset strategist at Morgan Stanley in London. “That would be another form of volatility. There’s always a risk of large moves when valuations are extreme — and the euro is quite cheap.”

The dollar index fell below 100 for the first time since early February and was down almost half a percent on the day. The currency was on the defensive after Chicago Federal Reserve President Charles Evans reinforced the perception that the U.S. central bank will not accelerate the pace of its interest rate hikes. He said on Monday that two more interest rate hikes this year were likely, disappointing investors who had anticipated rates would be increased more quickly. The greenback is on its longest losing streak since November after the Federal Reserve’s dovish message on the speed of monetary tightening last week.

European stock markets opened higher after a rally in Asia, where MSCI’s broadest index of Asia-Pacific shares outside Japan hit 21-month highs. U.S. stock futures pointed to a positive start for Wall Street, which had suffered on Monday as investors worried that President Donald Trump’s plan to cut taxes and boost the economy would take longer than expected to realize.South Korea led gains among Asian emerging markets, with the Kospi jumping 1 percent to the highest since July 2011. Hyundai Motor Co. climbed 8.6 percent amid market speculation over a possible stake purchase by Elliott Management. The Stoxx Europe 600 Index added less than 0.1 percent at 9:48 a.m. in London. Banking stocks outperformed, led by Italian and French lenders, as worries over the French presidential election further abated. Mining stocks lost ground, trimming recent sharp gains. Futures on the S&P 500 rose 0.1 percent. The benchmark gauge fell 0.2 percent on Monday.

The 10-year U.S. Treasury yield briefly fell to two-week lows following the comments to 2.461 percent. It last stood at 2.48%. Oil prices rallied on expectations that an OPEC-led production cut to prop up the market could be extended. Prices for front-month Brent crude futures LCOc1, the international benchmark for oil, gained 1 percent to $52.13 per barrel.OPEC members increasingly favor extending the output curb beyond June to balance the market, sources within the group said, although they added this would require non-OPEC members such as Russia to also step up their efforts.

Leave A Comment