In a quiet start to the week following last week’s surprisingly strong rebound which followed a stronger than expected jobs report (perhaps to demonstrate that good news is once again good news), Japan stocks continued to sink as the USDJPY dropped to fresh lows, while commodities declined for a fifth day as the supply glut from crude to copper weighed on prices, dragging down commodity currencies. European equities rose, rebounding from a one-month low.

Crude fell in early trading after Saudi Arabia’s deputy crown prince said last week the kingdom will only arrest production if Iran does, although it has since posted a modest rebound, while copper dropped to a one-month low. European stocks advanced after trading at their lowest valuations in more than a year relative to U.S. equities, even as France’s phone companies tumbled after a deal to consolidate the nation’s telecommunications industry fell apart.

“Three of the major commodities oil, gold and copper have all retraced in recent days,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S told Bloomberg. “Saudi Arabia caused a major upset on Friday by saying that a freeze deal was conditional of Iran joining which will not happen at this stage.” Copper and industrial metals have been hurt on concern China’s investment-led economic boom won’t be enough to avoid more cutbacks, he said.

In key macro news, Euro-area unemployment dropped to 10.3% in February down from an upwardly revised 10.4%, and the lowest level since 2011, in line with estimates. “I see this number as a movement sideways,” said Aline Schuiling, senior economist at ABN Amro Bank NV in Amsterdam. “This is a reflection of what is happening in the economy. Growth has clearly weakened in the second half of last year and the first quarter of this year will also probably be a bit weaker.”

Youth unemployment remained disturbingly high, with 21.6% of Europeans under 25 unemployed, just modestly lower than the 22.7% a year ago.

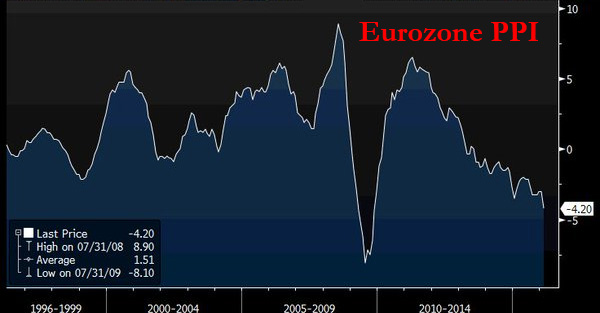

In other news, Eurozone producer price inflation also dropped, this time by -0.7%, and down -4.2%, to the most negative annual increase since the financial crisis.

The Stoxx Europe 600 Index added 0.8%, after being in the red earlier, while futures on the Standard & Poor’s 500 Index gained 0.2% despite the GAAP PE multiple on the S&P hitting approaching 24, the highest level since the dot com era. While U.S. stocks erased annual losses and closed at their highest level of the year on Friday, the rebound in European shares has stalled for more than two weeks. With a valuation of about 14.7 times estimated earnings, the Stoxx 600 traded at its lowest level since January 2015 relative to the S&P 500 on Friday.

This is where markets stood as of this moment:

Top News:

Leave A Comment