Gold is showing solid rallies from my $1310 area buy zone (basis April futures). From both a love trade and fear trade perspective, the fundamental picture is becoming more positive.

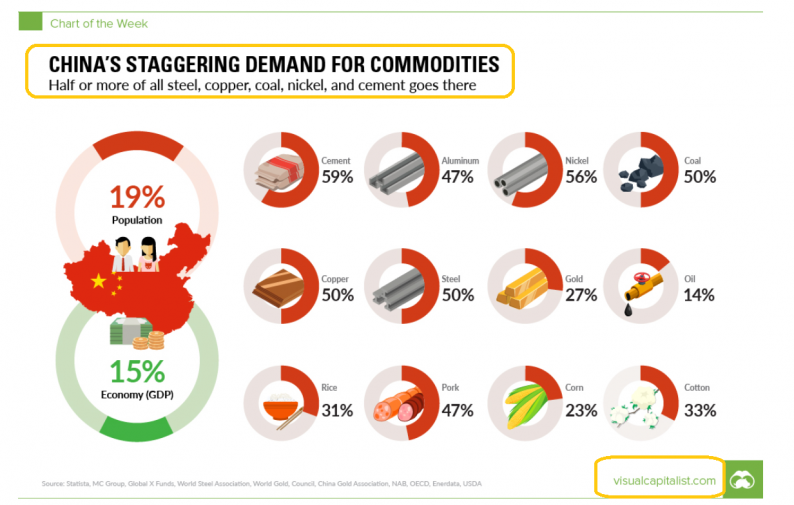

I’ve repeatedly highlighted the fact that while America has the world’s richest economy, China’s economy is vastly bigger.

Courtesy of the Visual Capitalist, this snapshot of Chinese commodity demand should provide a significant confidence booster shot for investors.

The huge demand puts a floor of support under commodities like gold… even on minor price declines.

Double-click to enlarge this daily gold chart.

Gold is rallying for a second time from my $1310 buy zone, and there is a positive non-confirmation in play with the Stochastics oscillator.

Since hitting the $1370 resistance zone in late January, gold has consolidated in a drifting rectangular pattern. The odds of an upside breakout from this pattern are about 67%.

Importantly, that breakout implies that the price would move above the huge resistance zone at $1370!

While the gold trading volume on the Dubai Gold & Commodities Exchange (DGCX) is nowhere near the size of COMEX volume, it’s growing relentlessly while COMEX volume appears to have peaked.

The SGE (Shanghai Gold Exchange) is helping the DGCX. The Sharia-compliant spot gold contract launch is quite important because it should bring more stability to the overall gold price discovery process.

A rise above $1370 against the background of rising institutional money manager concern about inflation in the West would be another huge confidence boost for investors, both in America and in China.

Double-click to enlarge.

The current price action of the dollar against the safe haven yen is truly horrific.

It’s another stronger indicator that gold is poised to move above $1370.

Double-click to enlarge.

The oil market price action is becoming concerning.

Leave A Comment