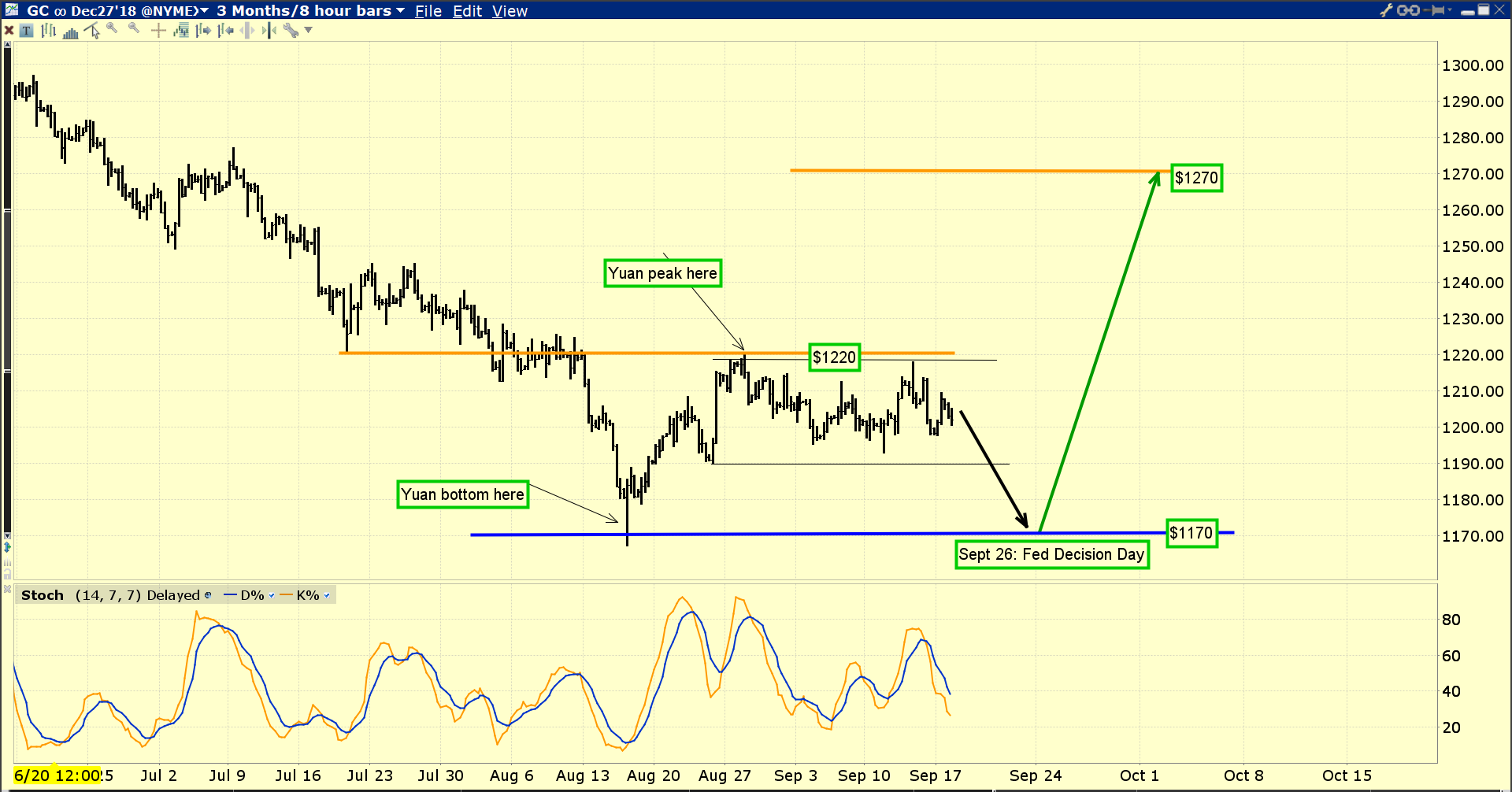

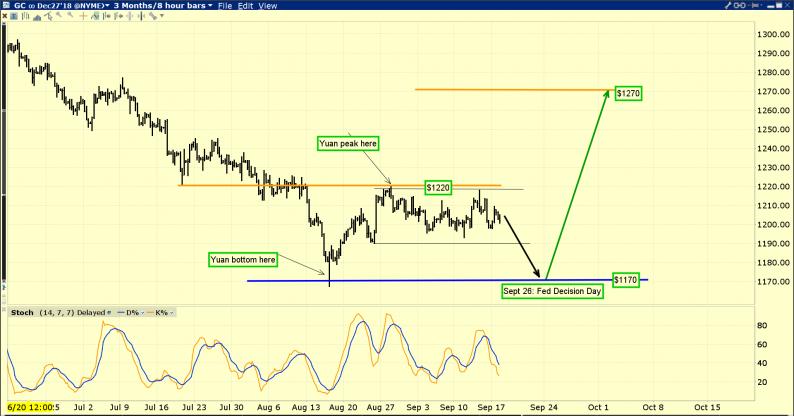

Ahead of the Fed’s key meeting next week, gold continues to meander sideways to lower.

Double-click to enlarge this key short-term gold chart.

I’ve referred to the US-China tariffs as a “trade skirmish”. Importantly, since the skirmish started, the price action of the yuan against the dollar looks almost identical to the price action of gold against the dollar.

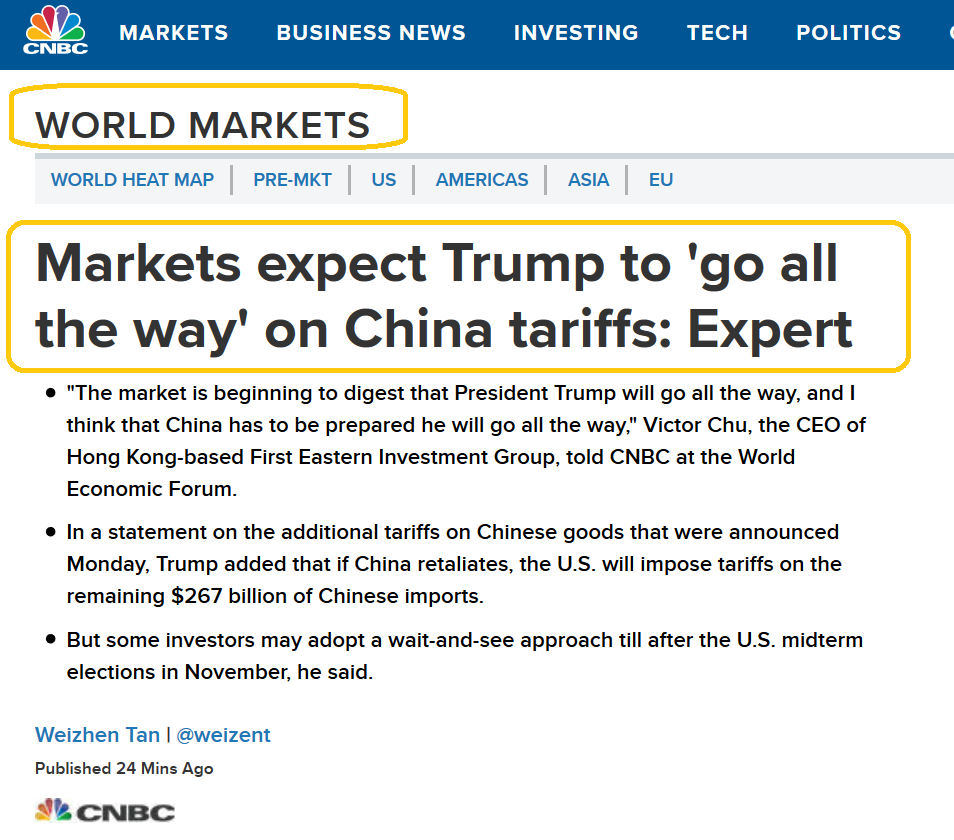

Tariffs are negative for the Chinese stock market and positive for the dollar. They don’t do much harm to the Chinese or American economies other than producing some mild inflation.

Having said that, because China exports more to America than America does to China, China can’t win a tariffs skirmish. What China can do is restrict exports of products that America needs, like rare earth minerals.

If that happened, the US government would almost certainly respond by refusing to export key electronics parts and agricultural products to China. That escalation from a skirmish to economic war would cause the US business cycle to peak pre-maturely, and the bull run in the US stock market would end.

Also, the Fed’s rate hikes and quantitative tightening are likely to make 2018 a peak for stock market buybacks, and Trump is on the warpath against market leaders like Twitter and Facebook.

The bottom line is that if the trade skirmish becomes a war and damages the US economy, Trump is going to become more likely to use some form of dollar devaluation as a weapon.

The IMF rules clearly state that countries cannot use currency manipulation to fix their trade deficits. Having said that, most governments have a habit of breaking rules.

Trump could try to convince other G7 members to launch a “Plaza 2.0” dollar devaluation. If that effort failed, he could simply ignore the IMF, or he could order the Treasury to begin a gold buy program, which is not a violation of IMF rules.

Clearly, many top bank FOREX analysts believe the trade skirmish will soon become a war involving currency devaluation. I put the odds that it happens at 50% now and trending higher!

Leave A Comment