Fundamental Analysis of Gold

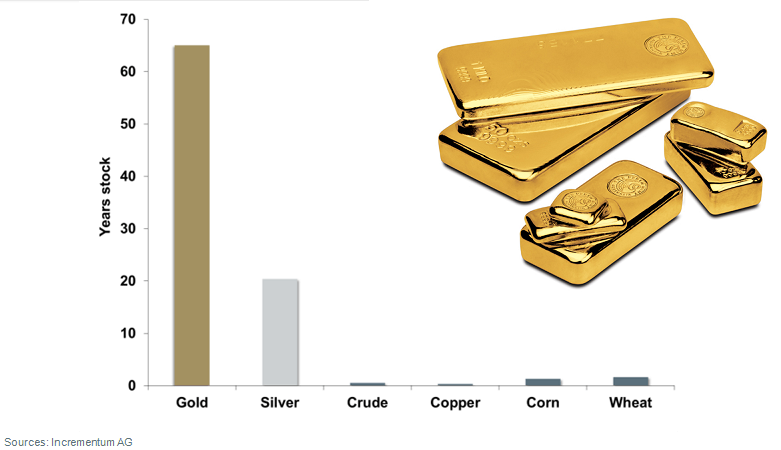

As we often point out in these pages, even though gold is currently not the generally used medium of exchange, its monetary characteristics continue to be the main basis for its valuation. Thus, analysis of the gold market requires a different approach from that employed in the analysis of industrial commodities (or more generally, goods that are primarily bought and sold for their use value). Gold’s extremely high stock-to-flow ratio and the main source of gold demand– which is monetary, or investment demand – suggest that gold has to be analyzed as though it were a currency rather than a commodity.

The stock-to-flow ratios of gold and silver compared to those of industrial and food commodities. Gold’s large StFR is one of the most important features (and to a lesser extent this also applies to silver) making it useful as a money commodity – click to enlarge.

One implication of this is that reservation demand is an extremely important factor in determining the gold price (for details on this topic see Robert Blumen’s essay “What Determines the Price of Gold”). Data on the annual flow of gold in terms of mining supply, jewelry demand, retail buying of gold eagles or net demand from central banks are insignificant by comparison.

Since none of us are mind readers, we cannot know the reservation prices/ supply schedules of current gold holders – they are not measurable. We do however know what motivates potential gold buyers and sellers, which allows us to analyze the market’s underlying trend by looking at the associated macroeconomic fundamentals.

Our friend Keith Weiner employs another approach, which attempts to determine the strength of physical gold demand by comparing spot gold prices to spreads in the futures curve. These spreads provide information on the incentives arbitrageurs have to buy or sell bullion against offsetting futures positions.

The extent of speculative buying in “paper gold” relative to buying in the physical market is one of the forces driving said spreads. Even though a data error has recently made it seem as though the derived “fundamental price” of gold was higher than it actually is, its current level of $1290 still remains above the market price.

We have recently remarked on the fact that the gold price is holding up relatively well in spite of the fact that most macroeconomic price drivers appear not particularly supportive at the moment. We will take a closer look at these drivers below.

There are essentially two types of gold price drivers worth discussing: measurable ones and those that cannot be measured (there is some degree of indirect overlap between them). The latter are inter alia described by Jim Grants simple gold price formula, according to which the price of gold is equal to 1/n. The variable “n” is “the trust in the capacity of people like Ben Bernanke [or Janet Yellen, ed.] to manage paper money”.

Drivers of the Gold Price

1. Real interest rates: when speaking about “real interest rates”, one has to define what one actually means. After all, the so-called “general level of prices” does not really exist. Adding up the money prices of completely disparate goods and services and then “averaging” them and calling the result the “general price level” is bereft of logic.

Leave A Comment