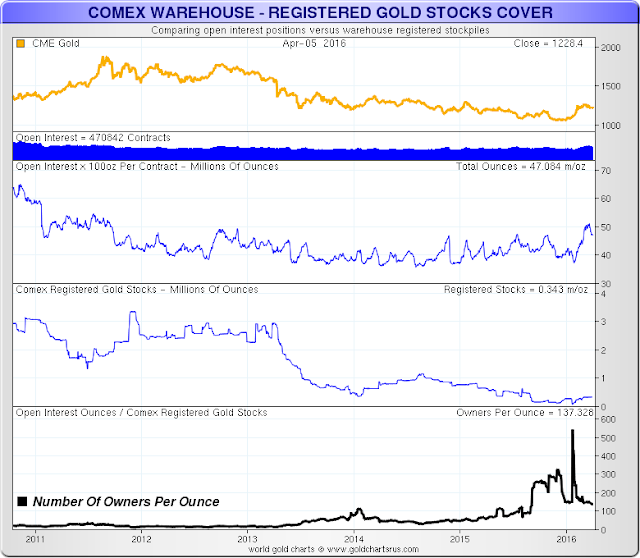

Interesting that gold spiked almost shockingly, and has subsided from there, but is still much higher than it has been for the past twenty years.

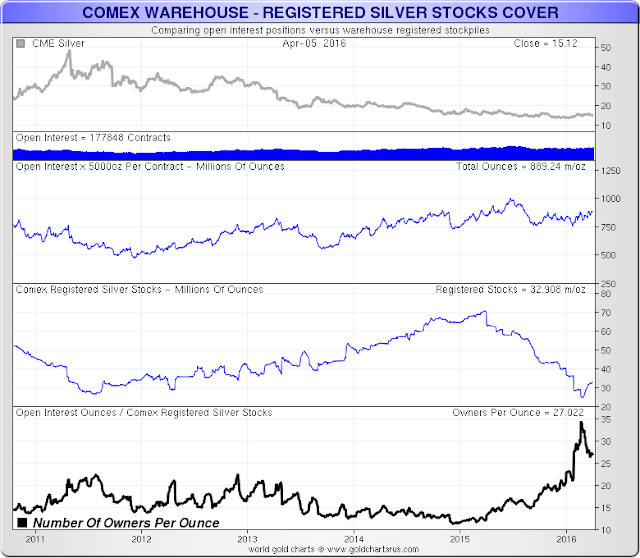

And now silver is spiking higher.

These are not indications of a hard default, as some have suggested. Rather, when taken with other data from different sources it suggests that there is pressure on the ‘free float of available bullion’ for immediate delivery.

Rickards thinks that, at least in the case of gold, there is 100 to 1 leverage on this bullion. And he may be right.

No wonder that the financial establishment is so off kilter and adverse about the demand for gold bullion and the price. And it appears that silver, quiet little silver, is bubbling up behind the scenes as well.

These charts are from goldchartsrus.com.

Leave A Comment