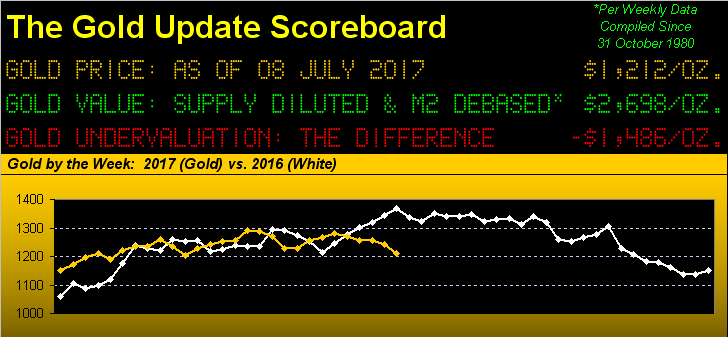

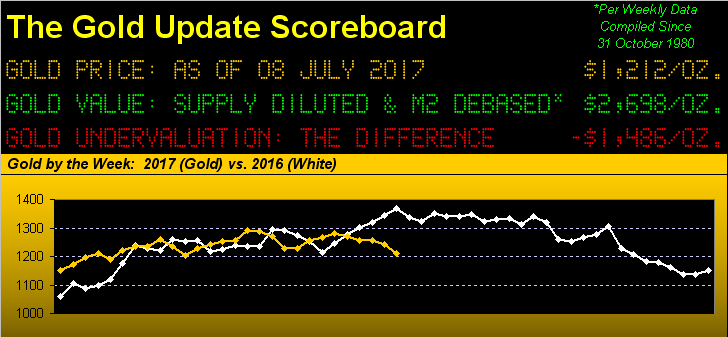

The good news is that Gold finally has departed its seemingly inescapable 1240-1280 box. The bad news is that such departure was beleagueredly to the south, price settling out the week yesterday (Friday) at 1212. To be sure, per the above opening panel, Gold’s performance in 2017 has turned from robust promise into no-thrust malaise, the yellow metal being booted about as a commodity rather than as the world’s longest-running, hard asset currency.

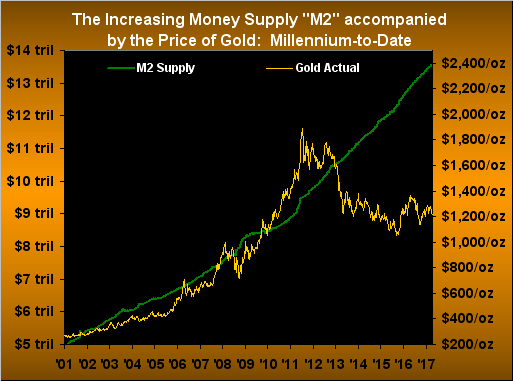

That said, ’tis paramount not to dismiss what we below view as Gold’s most important graphic. Here we have millennium-to-date the tracks of the StateSide money supply (“M2”) and the price of Gold. Note how they both rightly grew together, Gold on occasion lagging M2, indeed even getting ahead of M2, but in any event, always returning to M2, such logical move now way overdue. And look to where that would put Gold anew! Do not forget this very view:

“But mmb, with the Fed withdrawing liquidity, can’t that green line instead come back down?”

In their dreams, Squire. ‘Twould be like missing the shift gate in going from fourth to fifth, and oops, that was reverse. No sir, we don’t see M2 turning downward, barring a reinvention of the Dollar into an Amero, or heaven forbid, a Worldo. In fact, come the completion this September of the U.S. federal fiscal year, both the White House and Congress agree that spending for the first time ever shall have exceeded $4 trillion. That’s more than double what ’twas back in 1990 when George H.W. Bush was teaming up with Tip O’Neill in raising taxes, M2 back then being $3 trillion. Now ’tis $13 trillion. And yet Gold today is but a paltry 1212?  “Wake up little Susie…”

“Wake up little Susie…” –(Everly Brothers, ’58, when the stable Gold-based Dollar was great).

–(Everly Brothers, ’58, when the stable Gold-based Dollar was great).

Hardly great as we next see per Gold’s weekly bars was the latest parabolic Long trend (blue dots), an abject four-week failing flop which has now flipped to Short (red dots). ‘Course, because Gold had been stuck in its 1240-1280 box for an eternity, the prior Short stint of its own accord saw price rise instead of fall. Annoyingly, the beautiful sweeping precision trends throughout much of the graphic have morphed into random paint-ball shots:

Leave A Comment