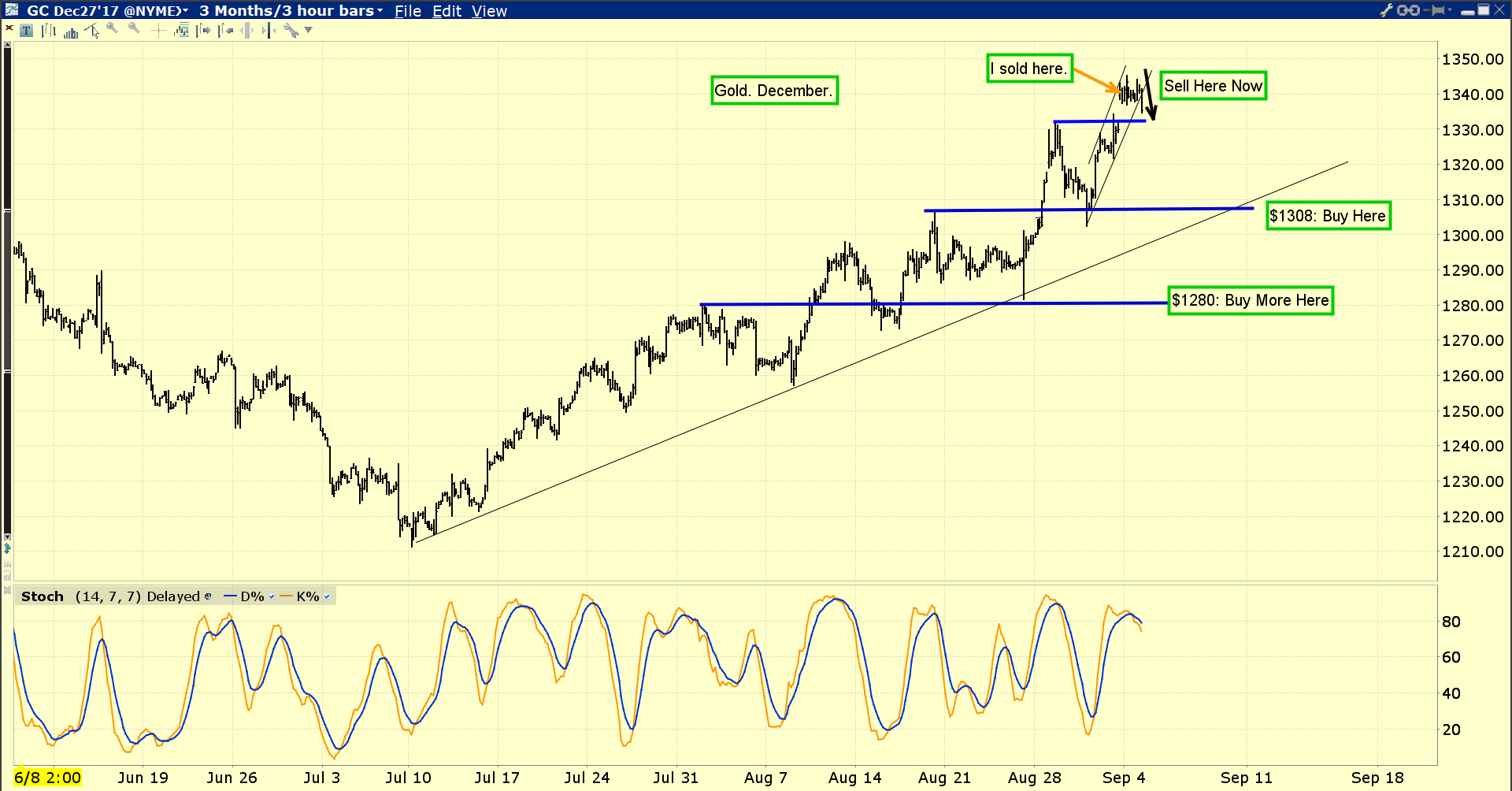

Gold has staged a fabulous rally from about $1220 to $1245. Using the December futures price chart, I’ve defined the $1300 – $1350 area as a spectacular profit booking opportunity for investors.

I’m an eager gold bullion seller now, but I’m less eager to sell gold stocks or silver bullion. That’s because they have not taken out their February highs while “Queen Gold” has done so easily.

Gold has clearly been the leader. It’s been a great upside ride, and now it’s time for investors to book solid profits with a big smile.

I’ve been adamant that gold is on the cusp of a two hundred year “bull era”. It’s themed around the love trade in China and India. For that reason, core positions should not be sold, but short term positions bought in the $1200 – $1250 area should definitely be sold aggressively now.

Investors who are nervous that they will miss out on more upside action should buy call options while selling some bullion. Call options are like lottery tickets; if gold surges above $1350 and runs to $1400, the call options will rise in value quite significantly.

On the other hand, if gold declines to either of my $1308 or $1280 key buy zones, the loss on the options is small, and the investor has plenty of dry powder to buy more gold bullion, ETFs, and futures.

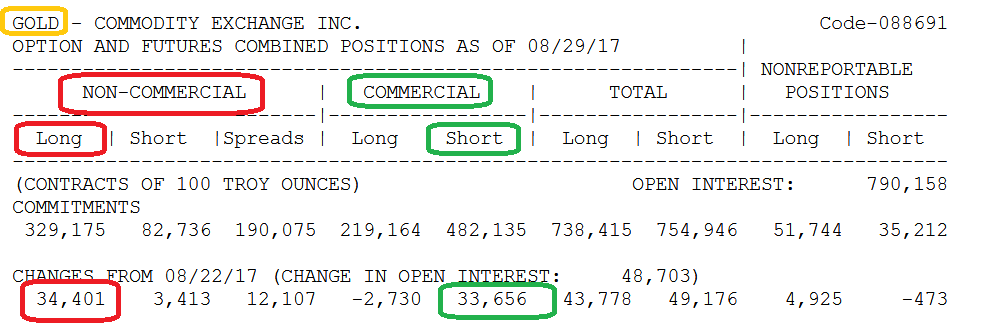

Clearly, the deep-pocketed commercial traders are aggressive sellers now.

This COT report covers the action through last Tuesday. In my professional opinion, the commercial traders have probably shorted another 50,000 to 100,000 COMEX contracts since that report came out, and sold a significant number of long positions.

Amateur gold investors don’t need to sell as aggressively as the commercial traders do, but history suggests that investors who book modest gold market profits when the commercial traders are aggressive sellers tend to be making a wise tactical decision.

Leave A Comment