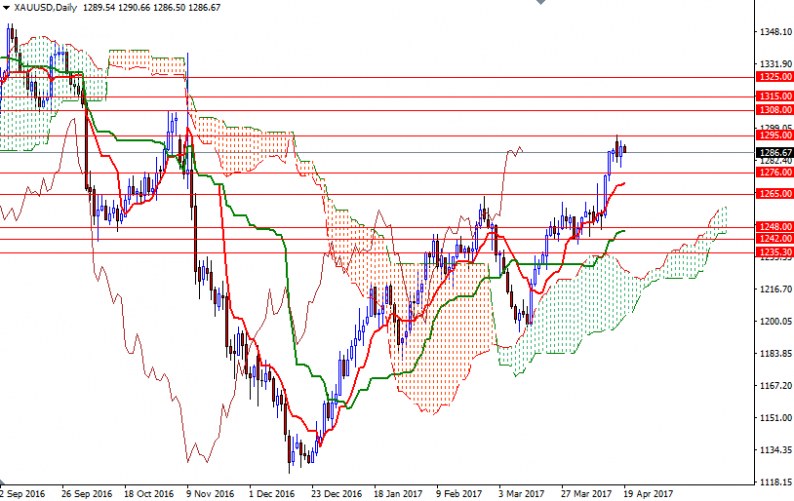

Gold prices ended Tuesday’s session up $5.25 as weakness in U.S. and European equities a drop in the U.S. dollar lent some support to the precious metal. The XAU/USD pair initially headed towards the $1277.35-1276 area after the market dropped below $1281, but found support in the vicinity and tested the $1292 level. As the key levels are holding, gold is still stuck within the trading range of the past three days in Asian trade today.

To the upside, there are hurdles such as 1292 and 1295. A break-out will attract new buying and will probably force shorts to cover their positions. A failure, however, will likely result in liquidations.

If the market climbs above 1295, we may see the bulls make a run for 1308/4. Falling through 1276, on the other hand, could pull the market back to the 1265 level where the top of the 4-hourly cloud currently sits. On its way down, support may be seen at 1272 and 1269.

Leave A Comment