Commodities continued to rise as expected, reveling in US Dollar weakness triggered following Wednesday’s underwhelming US CPI data. Gold prices capitalized as the greenback’s weakness bolstered the appeal of anti-fiat alternatives. Meanwhile, crude oil prices enjoyed a de-facto lift because they are denominated in terms of the benchmark currency on global markets.Firming risk appetite seemingly helped as well.

Looking ahead, the University of Michigan gauge of US consumer confidence headlines the calendar, with a slight downtick expected. Baker Hughes rig count data as well as futures speculative positioning statistics from ICE and the CFTC are also due. None of these releases seem potent enough to derail established momentum. A bit of profit-taking before the weekend may produce corrective price action however.

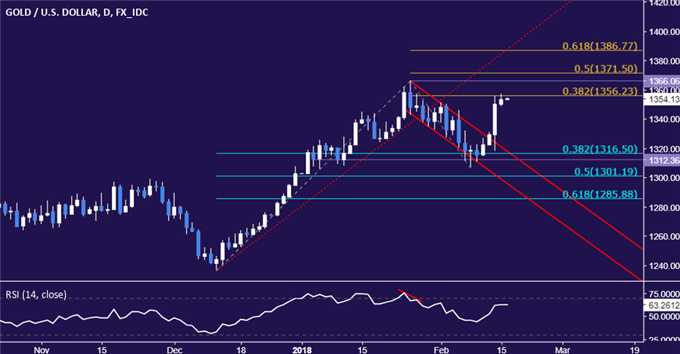

GOLD TECHNICAL ANALYSIS

Gold prices’ advance paused on a test of resistance marked by the 38.2% Fibonacci expansion at 1356.23. A break above this barrier confirmed on a daily closing basis opens the door for a test of the 1366.06-71.50 area (January 25 high, 50% level). Critical support remains in the 1312.36-16.50 region (38.2% Fib retracement, support shelf).

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices managed to reclaim a foothold above the $60/bbl figure, challenging the 14.6% Fibonacci expansion at 61.64. A daily close above this barrier exposes the 63.41-85 area (former support, 23.6% level). Alternatively, a reversal below the 38.2% Fib retracement at 57.25 targets the 50% threshold at 54.36.

Leave A Comment