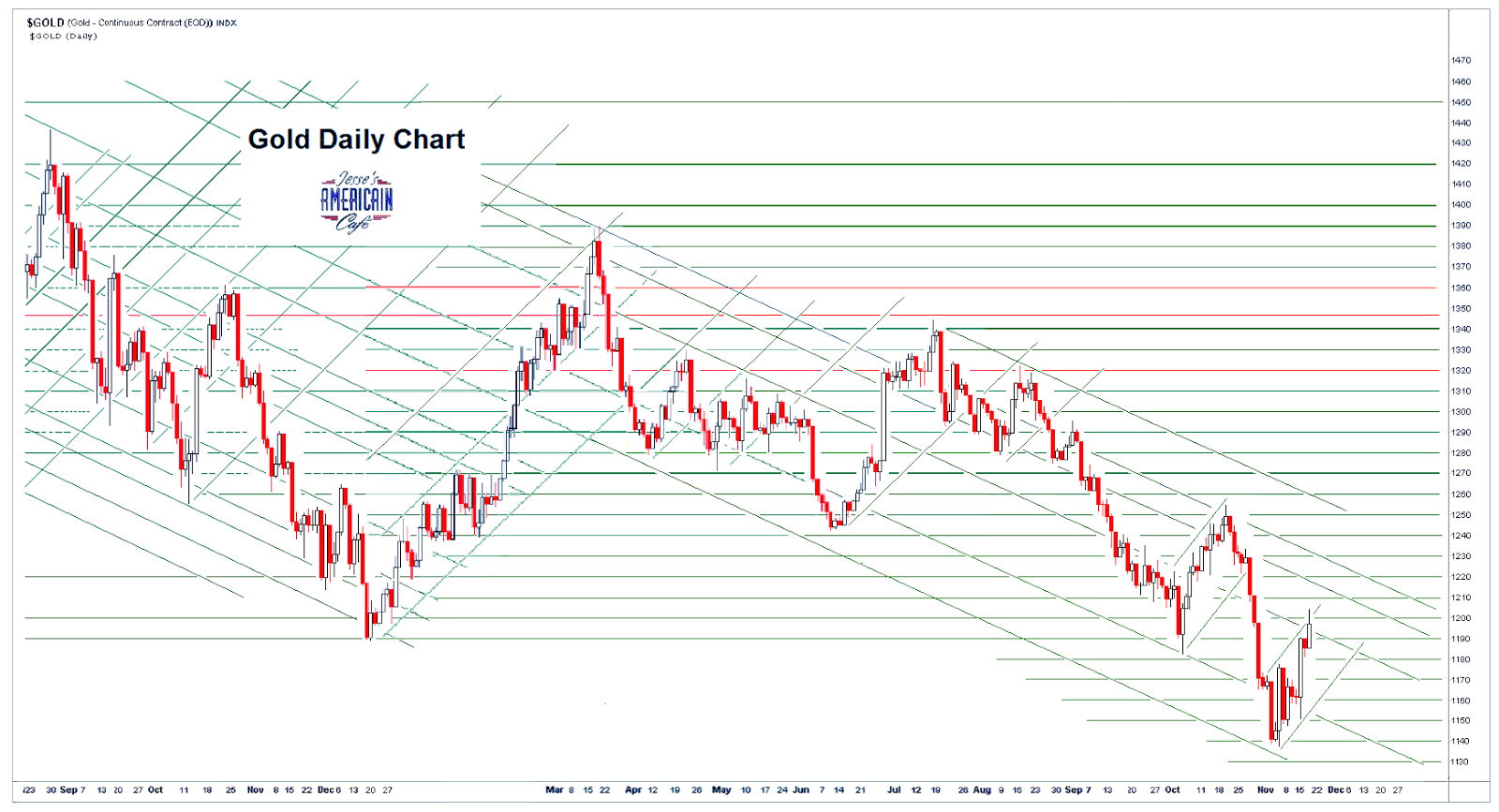

Gold took an early run at breaking out, but then was held at the overhead resistance and ‘psychologically important’ 1200 level. We’ll have to see if gold can rise above resistance and break fee, and change this downtrend of lower highs and lower lows.

Someone asked me to comment on the notion that price manipulation is not possible in large markets like the precious metals. I cannot believe that this canard is being taken seriously again at this late date.

I hope you realize that when someone says that given supply and demand there can be no price manipulation in the metals markets they are citing the ‘efficient market theory’ as the basis for their disbelief.

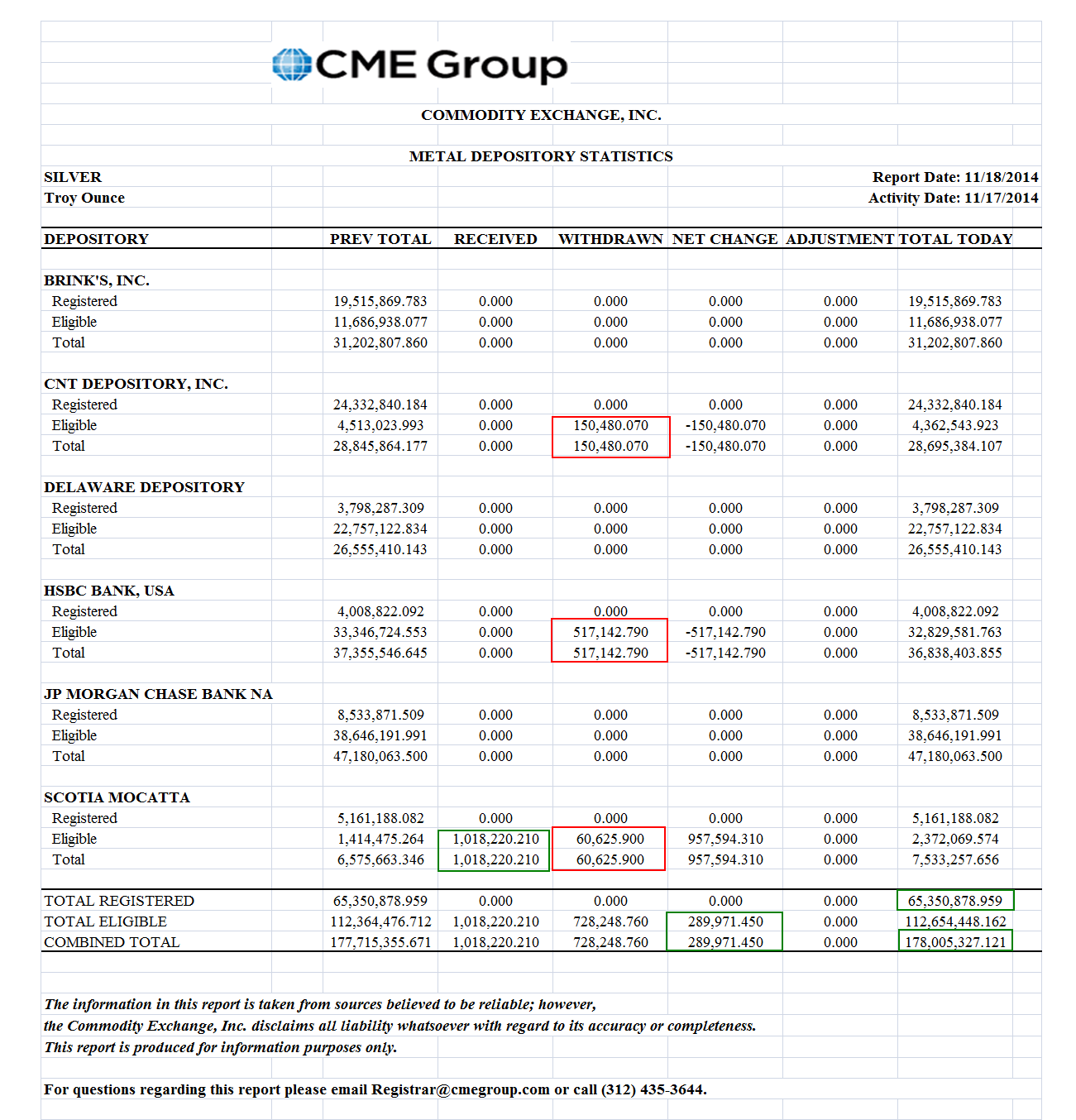

That is not to say that this proves that there is manipulation. There are plenty of other indications of that. But it does not mean that there can not be market manipulation. Prices are set at the margins, and given leverage and favorable regulatory climates prices and demand/supply can become seriously disconnected.

Markets can get out of sorts with value for a long time, and years in some cases of bubbles, if enough energy and effort is put into it. And especially in times of lax regulation and lack of transparency, there can be widespread price manipulation for a number of reasons.

Do we really have memories that are this selective and short term?

Have a pleasant evening.

Leave A Comment