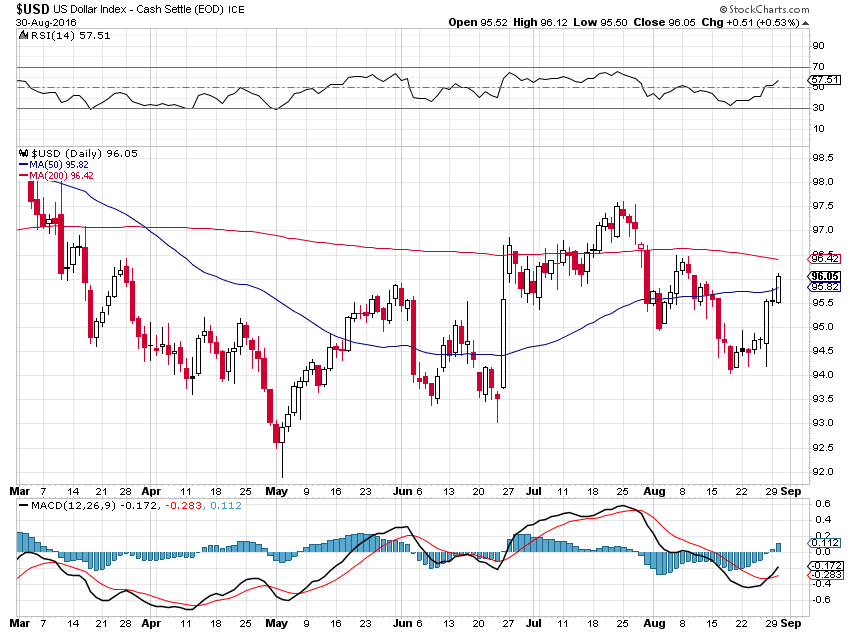

Bernanke’s mentor and Fed Vice-chair Stanley Fischer performed for the financial class as expected this morning, making hawkish sounds on interest rates. More specifically he cast doubt on the notion of a ‘one and done’ for interest rate increases this year.

Well, Stan, let’s see if you all have enough resolve to give the markets ‘one’ 25 bp raise before you start talking your book too aggressively about more. So far the FOMC has as much conviction to do the right thing as a drunken sailor in a bar on a late Friday night.

As well they might. It’s a good thing they are on fat salaries and not piecework, because so far they have failed at just about every thing they have done, and often spectacularly so.

Except that they ‘saved the Banks’ and Wall Street’s bloated corpse, for which we are supposed to be grateful. Give a decent person with good common sense and practical judgement nine or ten trillion dollars in walking around money, and I suspect that they will do a lot more with it, guaranteed. And you will see something tangible out of it, besides overpriced condos and a proliferation of commercial rent traps.

Well, at the end of the day, they just want to get farther off the zero bound so they have room to perform their policy rates when the next crash comes as a result of their policy errors and serial bubbles in financial assets.

What a system they have ‘saved.’ What they have really saved is a rigged game that benefits a few, and at the expense of most everyone else.

Have a pleasant evening.

Leave A Comment