It was more back and forth with gold and silver today.

I thought I had already given a fairly complete overview of what I think is happening in the precious metals markets. Perhaps I need to repeat it with just a little embellishment.

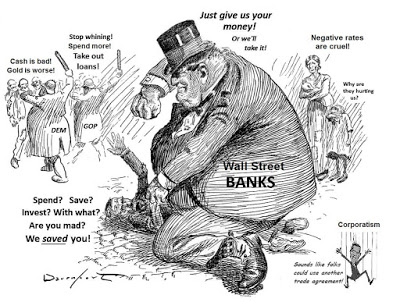

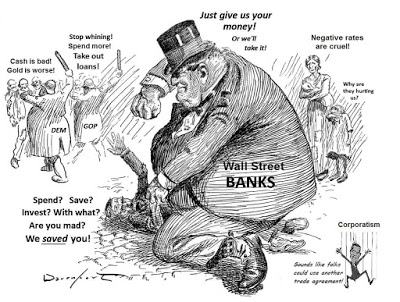

And just for grins, although it does contain some satirical exaggeration just for effect, the cartoon to the right is pretty much how I conceive our current situation and the real economy. Our financial problems cut right to the bone of who we are and how we are conducting ourselves as a society.

We have just seen an historically significant decline in the precious metals in terms of days lower without relief. And we have seen a remarkable rise in the US dollar index against the Euro and the Swiss franc that cannot possibly be good for the real economy of the US, when every other developed nation is trying to devalue their currencies to stimulate their exports and inhibit imports.

I believe that a portion of the gold selling in particular is an effort to knock down the open interest in gold for December. Why? Because of the incredibly high ratio of open interest to deliverable gold, which I publish frequently and was among the first to do so, although Nick Laird is the data wrangler pre-eminent on this. If there was any serious attempt for holders of those contracts to stand for delivery, even JPM, which has been obviously building up its stores of gold to act as the ‘fixer’ in that market, would not be able to cover the demand.

JPM was consistently taking delivery for their house account in gold, and just transferred 70,000+ ounces over from Nova Scotia’s warehouse, from whom they had been taking delivery.

As we know, in the last big delivery month, JPM stepped up with an enormous amount of their gold, 400,000+ ounces, to provide enough real bullion to satisfy the contracts standing for delivery. Even now their inventories remain somewhat depleted.

The dollar has also been soaring, because the Fed is trying to pretend that the US is recovering so that they can raise rates. A strong dollar and higher rates are very harmful to what is almost undoubtedly a fragile economic recovery in the US.

And it is fantasy to think that the US can somehow go it alone, and continue to improve while the rest of the world is cutting rates because their economies are slowing.

The Fed wants to raise rates for their own policy purposes, so they can cut them, without going overtly negative, when their latest financial bubble starts to collapse, which it may already be doing. They cannot really raise rates in a Presidential election year past June, so they will push ahead, to serve their own purposes, even as they harm the real economy.

There will be another financial crisis as the IMF warned today. There will be a serious dislocation in several financial markets, including the precious metals and the bonds at some point, that will rock the current system to its foundations.

It is the credibility trap which ensnares the ruling class that inhibits any meaningful remedy and reform. Consequently I do not think we are in for an easy or peaceful time. As you may recall, I think the next imperial president may be our ‘Nero.’ This is by way of saying that unless we change our ways, it will get worse before it gets better.

Leave A Comment