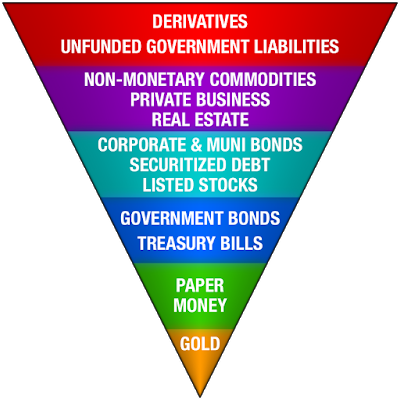

“We are in a world of irredeemable paper money — a state of affairs unprecedented in history.” – John Exter

It may be unprecedented, but it certainly seems so comfortable to the one percent and their courtiers so that they are willing to let it run and call it ‘the new normal.’

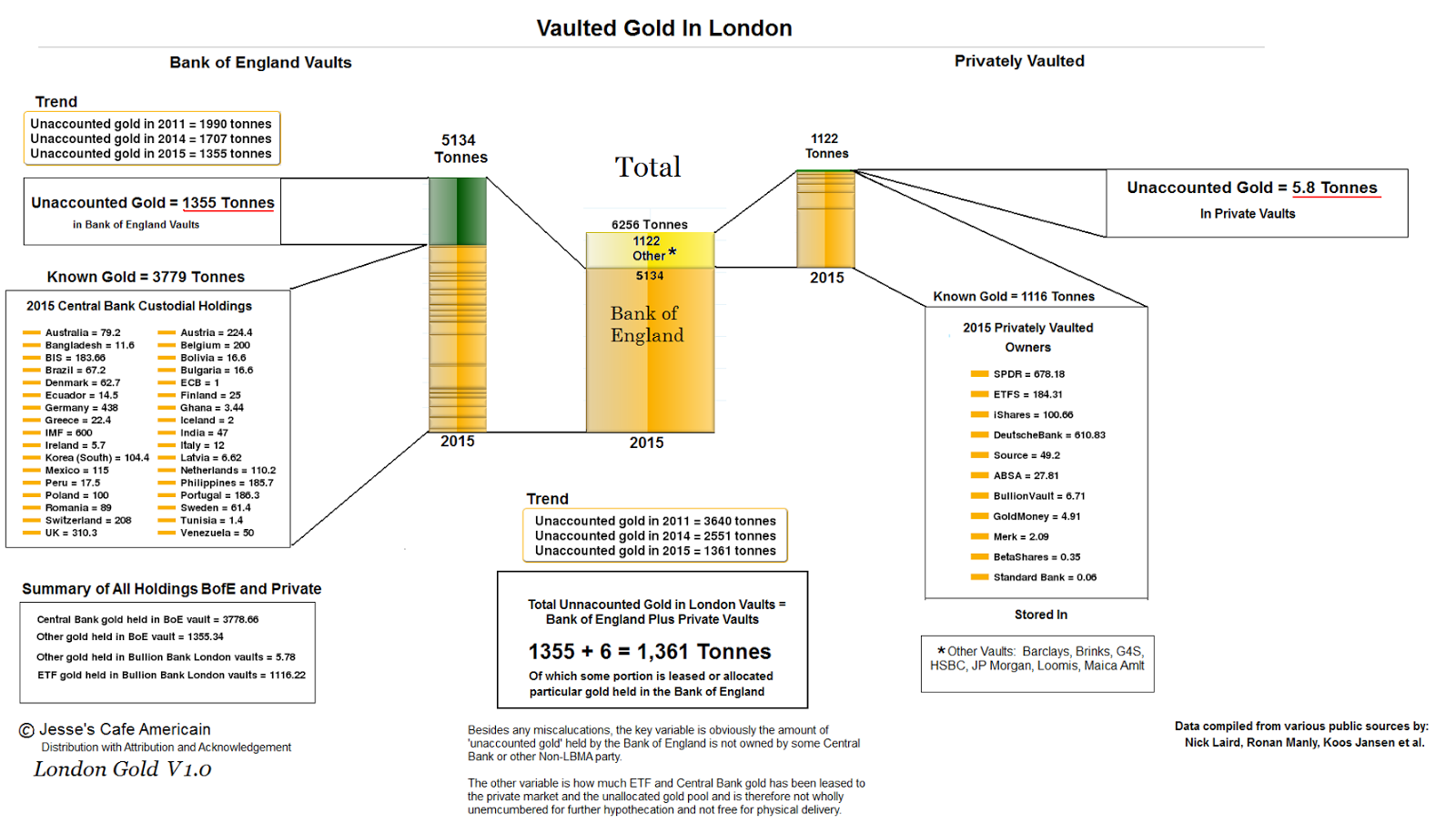

There was significant intraday commentary regarding gold and silver to read if you have not done so already. And I would especially urge you to have a look at the first of these. It may seem complex at a glance, but much of that is support for the first few paragraphs.

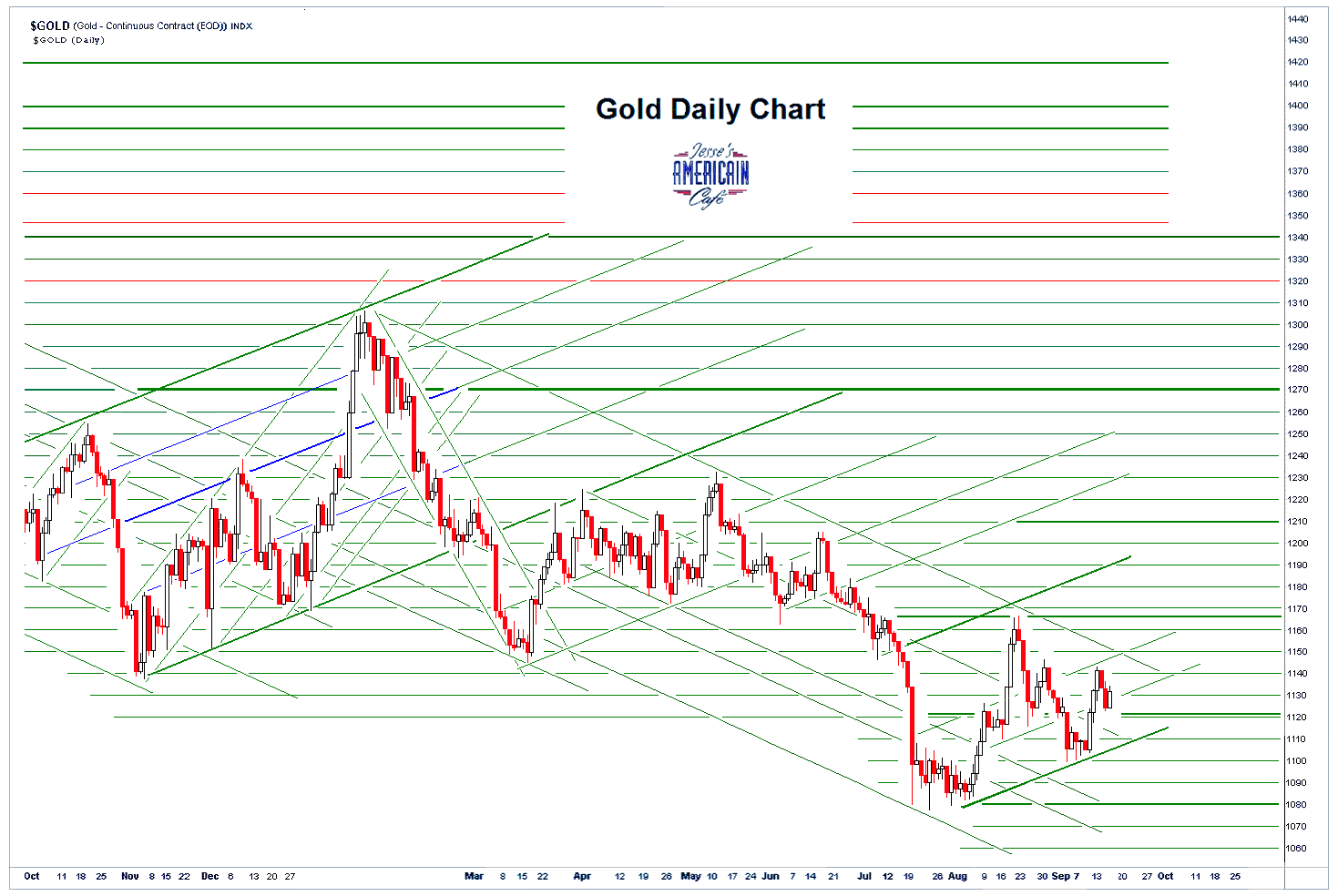

Surprisingly Tight Supply of Available Gold in London Compared to Ongoing World Demand and Physical Tightness in the Flow of Gold Is Reflected in the Price ‘Not At All’

There was also some overnight commentary Premiums for Silver Coins Continue Running Much Higher than Spot.

I have included below a single slide that attempts to dissect the gold holdings in London and account for all of those that have any knowable allocation to help to discover why the supply of gold is said to be so tight in London and the price is in backwardation, an unusual condition for the precious metals.

Below that is John Exter’s inverted pyramid of monetary risk.

For a balanced portfolio you may wish to include something from the narrower base of the pyramid.

Have a pleasant evening.

Click on picture to enlarge

Click on picture to enlarge

Click on picture to enlarge

Leave A Comment