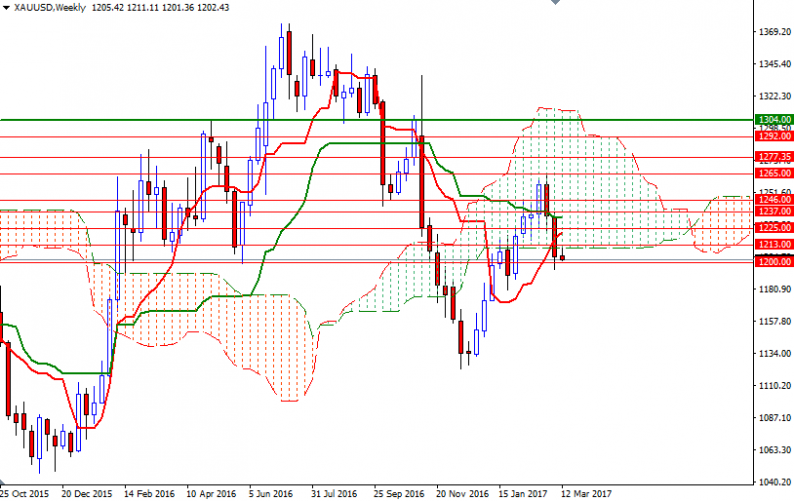

Gold prices dropped $1.7 an ounce yesterday as a stronger dollar and gains in equity markets weighed on the metal and investors awaited outcome of the Federal Reserve’s policy meeting. Fed officials will update their forecasts for the growth, unemployment and inflation, and Chair Janet Yellen is scheduled to give a post-meeting press conference. The key levels remain unchanged, as the market is stuck in a relatively tight range.

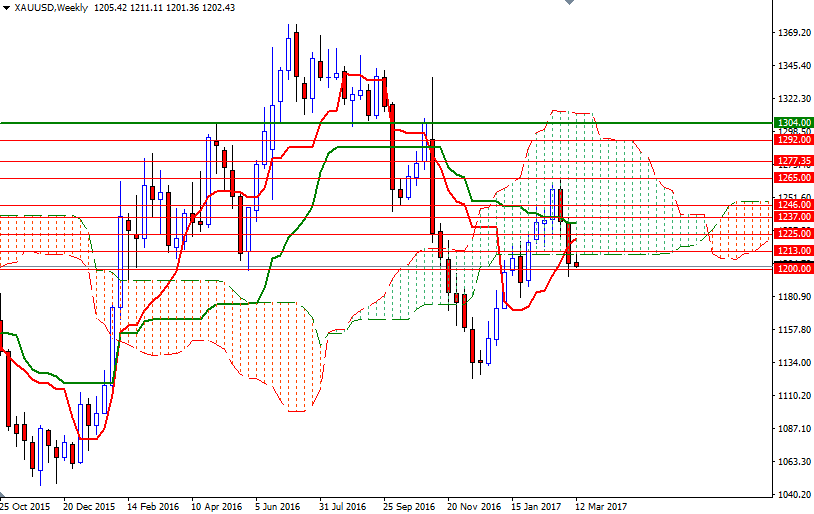

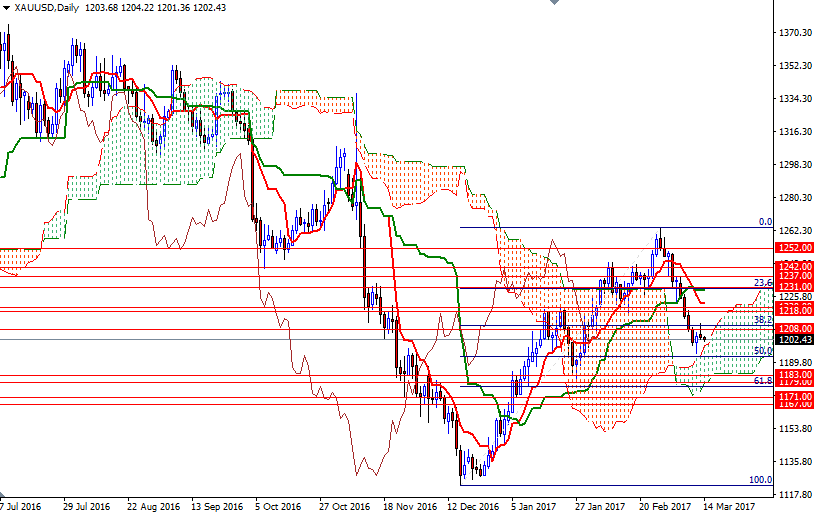

Prices are located in the opposite sides of the daily and 4-hourly Ichimoku clouds – XAU/USD is above the daily cloud but below the 4-hourly cloud. The fact that we have seen a hammer followed by a shooting star on the daily time frame also suggests that the market will tend toward consolidation. Technically, Ichimoku clouds not only identify the trend but also define support and resistance zones. The thickness of the cloud is relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud.

The bulls will have to overcome the barrier in the 1210/08 zone, which represents the 38.2% retracement of the bullish run from 1122.63 to 1263.84, so that they can proceed to 1214/3. If this resistance is broken, then it is likely that the market will test 1220/18 afterwards. Down below, keep an eye on the anticipated support zone between 1200 and 1198. A break below there could send prices back to the 1193/1 area. Breaching this support on a daily basis would open up the risk of a move towards 1179/6.

Leave A Comment