“Mr. Gold, you have disappointed us! But, really, you dropped almost four percent in the third quarter of this year.” This is what many analysts could say. But we warned our Readers against being bullish in the current macroeconomic environment. We invite you to read our today’s article about the gold market in Q3 2018 and find out what happened – and what are the implications for the end of the year.

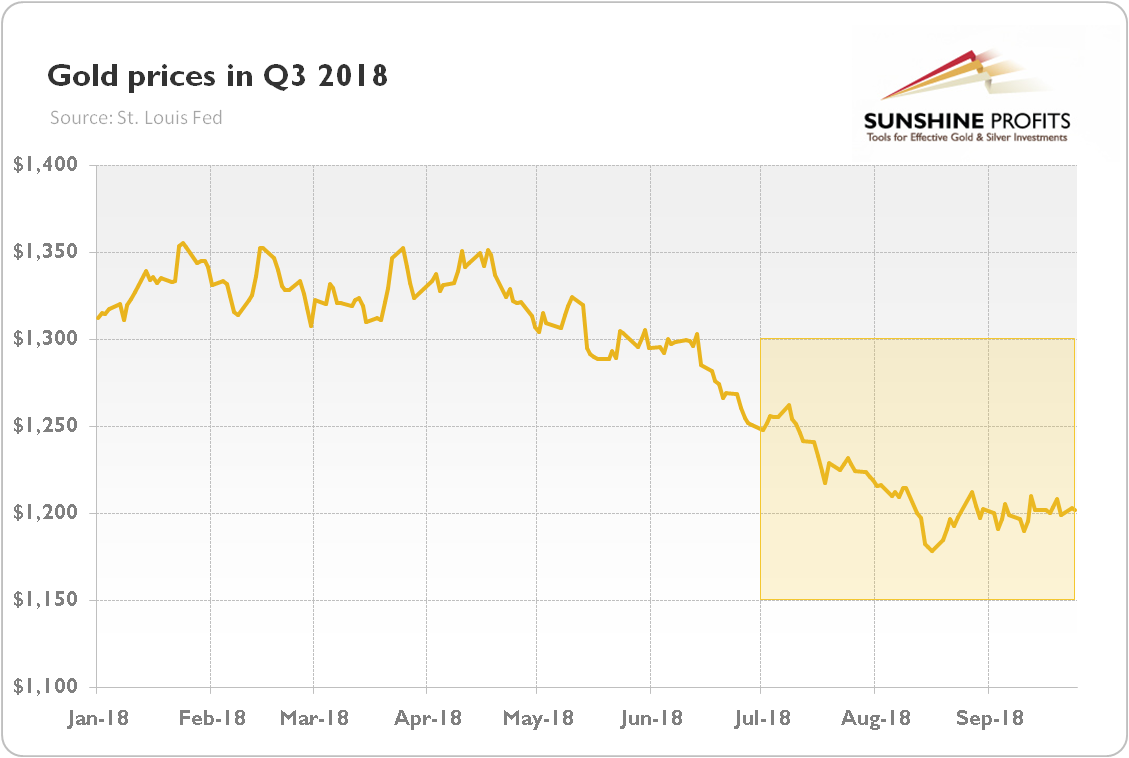

Almost four percent. Over the three months. So bad. But we have been warning our Readers for some time. For example, in the previous edition of the Market Overview, we wrote that “our conclusions remain rather bearish for the medium term”. And indeed, as one can see in the chart below, the price of gold declined about 3.8 percent in the third quarter of 2018 (until the September FOMC meeting).

Chart 1: The price of gold in U.S. dollars in Q3 2018 (London P.M. Fix, in $).

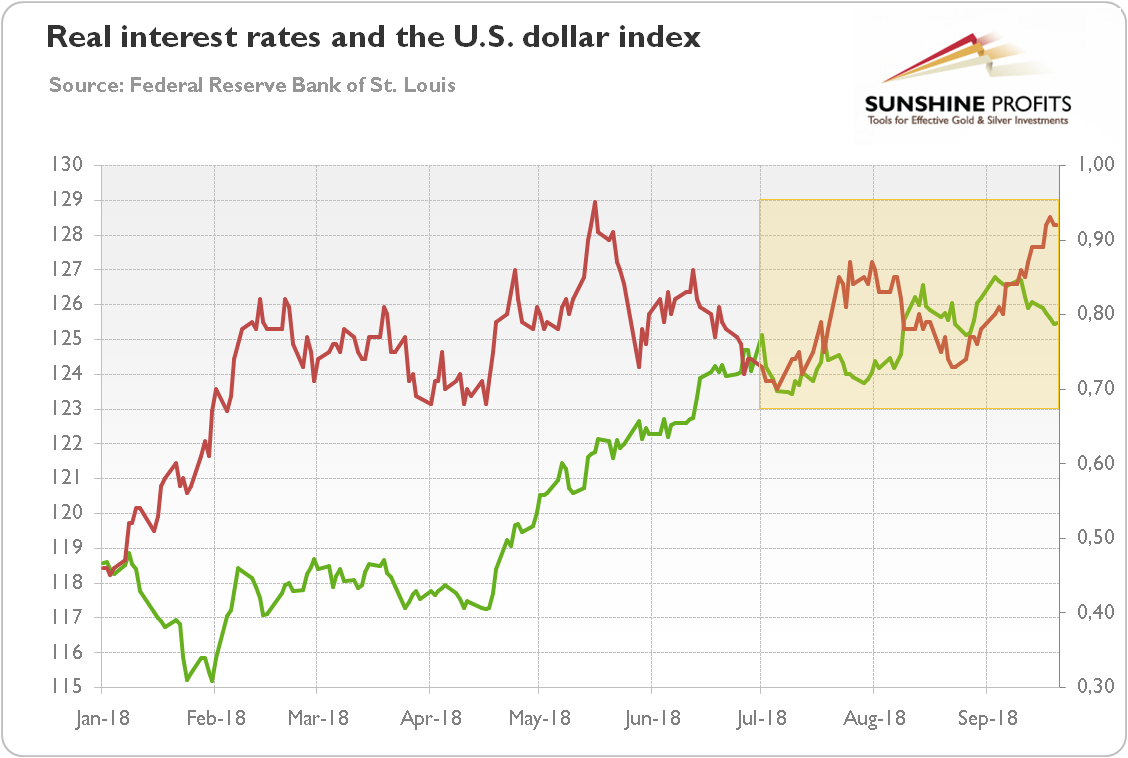

What happened? To find the answer, look at the next chart. As one can see in the chart below, the US dollar continued its upward trend. It was a headwind for gold. And the real interest rates, after pullback in May and mid-June, increased. It was a very important development, as the yellow metal has been dragged down earlier mainly by a stronger greenback. When both dollar and real interest rates act in tandem, the downward pressure on gold could only be larger.

Chart 2: The U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) and the U.S. dollar index (green line, left axis, Trade Weighted Broad U.S. Dollar Index) in Q3 2018.

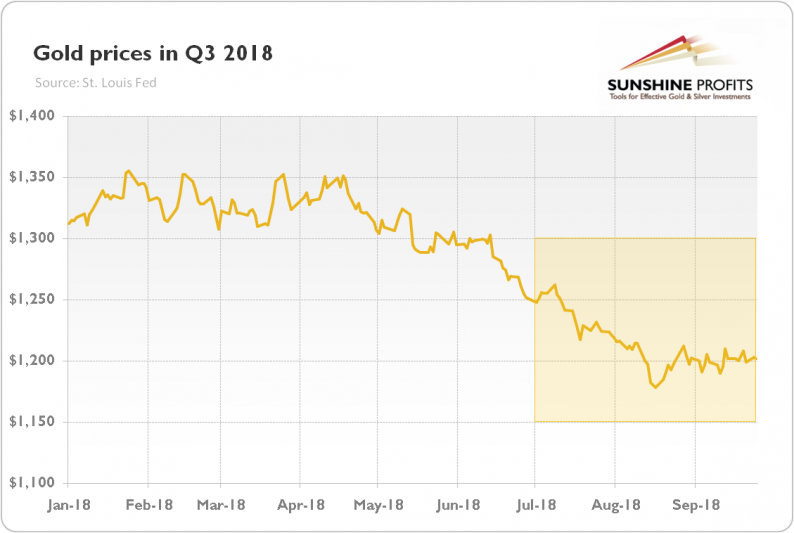

The risk premium also did not help gold. As the chart below shows, both the VIX and the credit spreads were stable or even declined in the third quarter of 2018. And what is important, the indicators of risk premium dropped despite all the hype around the trade wars.

Chart 3: The market volatility reflected by the CBOE Volatility Index (green line, right axis) and the credit spread reflected by the BofA Merrill Lynch US High Yield-Option Adjusted Spread (red line, left axis) in Q3 2018.

Leave A Comment