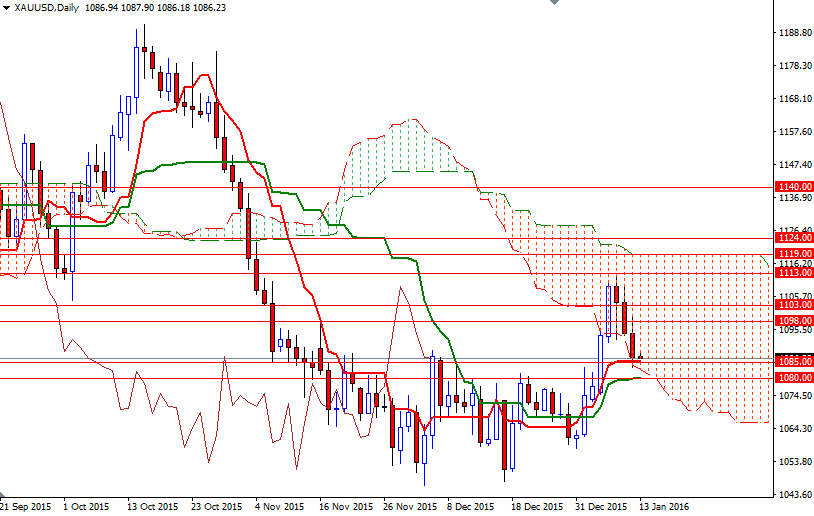

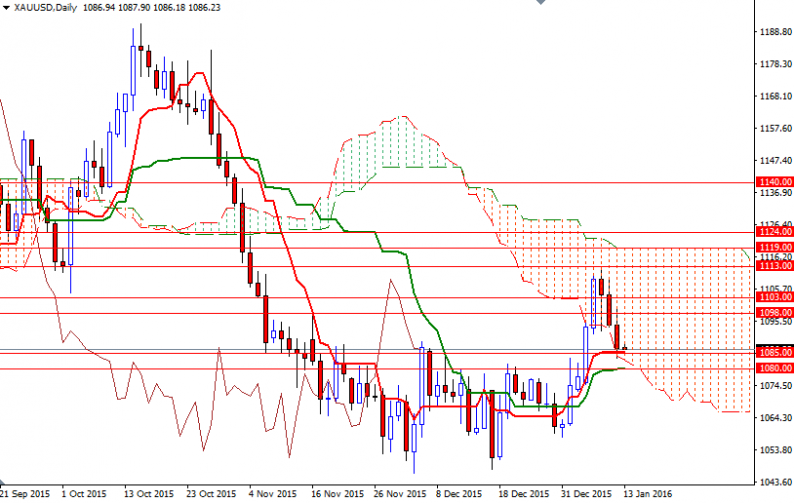

Gold prices slipped for a third straight session on Tuesday as the dollar strengthened across the board and dimmed the metal’s appeal. The market initially traded as high as $1099.11 an ounce in the Asian session yesterday but couldn’t gather enough momentum to penetrate the resistance in the 1099.50-1098 area and consequently headed lower and tested the 1085 support as expected. The XAU/USD pair has been making lower highs and lower lows since the market failed to break through the crucial barrier at $1113.

The market is hovering above an interesting support zone at the moment. This support below, between the 1085 and 1080, was the ceiling of a two-month long consolidation period and now both the daily Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines converge in the same area.

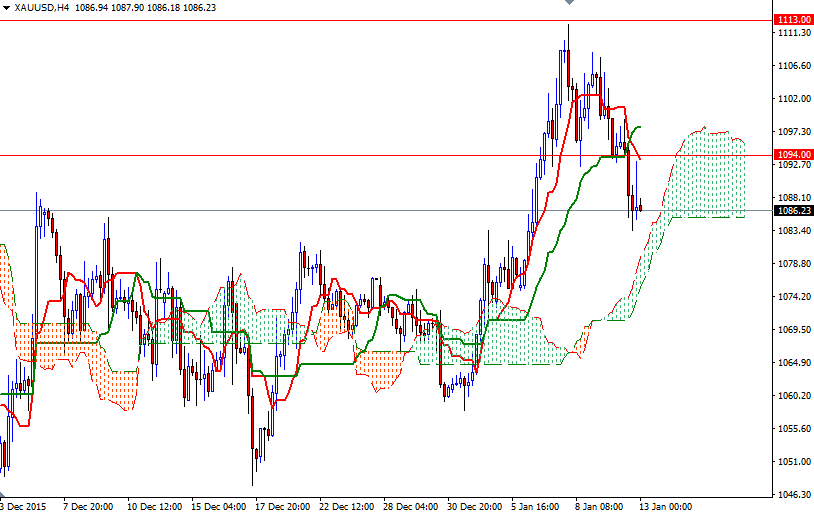

If the fall halts in this region and prices reverse, the market will probably head towards the hourly Ichimoku cloud, occupying the 1094/0 region. Clearing the resistance at 1094 would make me think that the bulls are ready to challenge the bears at the 1099.50-1098 battle field. On the other hand, if the bears increase the downward pressure and the 1080 support is shattered, then the 1075 and 1068 levels will be the next stops. Closing back below 1068 would open a path to the 1058 level.

Leave A Comment