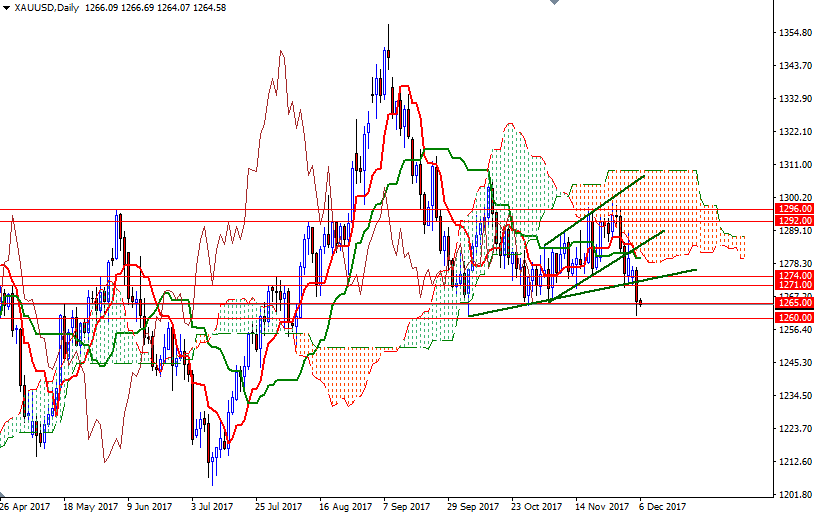

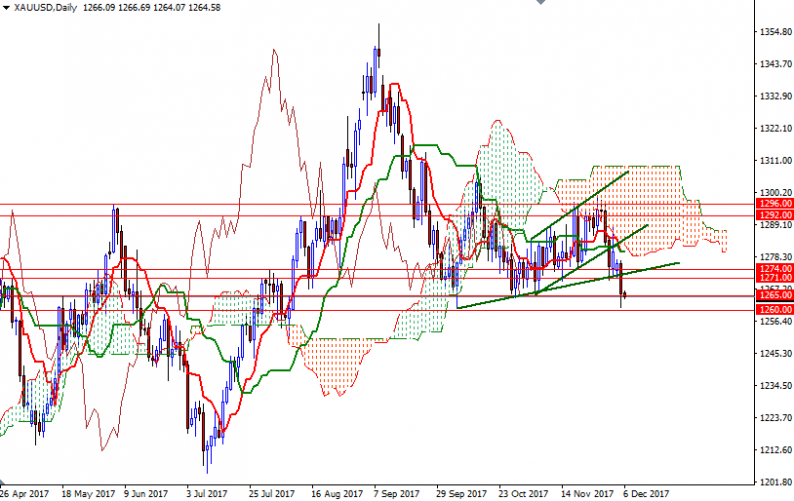

Gold prices dropped $10.34 an ounce on Tuesday as a stronger U.S. dollar and technical selling pressure continued to weigh on the market. XAU/USD initially made a move towards the resistance at $1277 but the market reversed its course after the bulls failed to overcome this barrier. As a result, prices tumbled below the $1274-$1271 zone and tested the support at around the $1260 level.

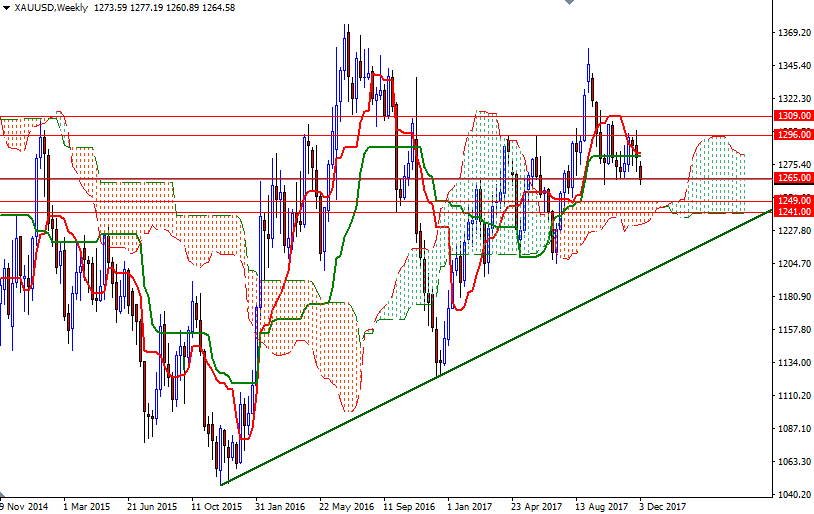

XAU/USD is still trading below the Ichimoku clouds on both the daily and the 4-hourly charts. The Chikou-span (closing price plotted 26 periods behind, brown line) which is below prices also suggests that the bears have technical momentum on their side. The near-term charts indicate more price pressure is coming but note that the market is trying to stay above the 1265 level. At this point, also keep an eye on world stock markets, which are mostly weaker this week.

If the bulls can hold prices above the 1265 level, expect a bounce towards 1269.10-1268. Beyond there, the bears will be waiting in the 1274/1 zone. The bulls have to produce a daily close above 1274 in order to gather momentum for 1277.20. To the downside, pay attention to the intra-day support at 1263.20. If this support is broken, the market will be aiming for 1260. Breaking below 1260 opens up the risk of a fall to 1255.

Leave A Comment