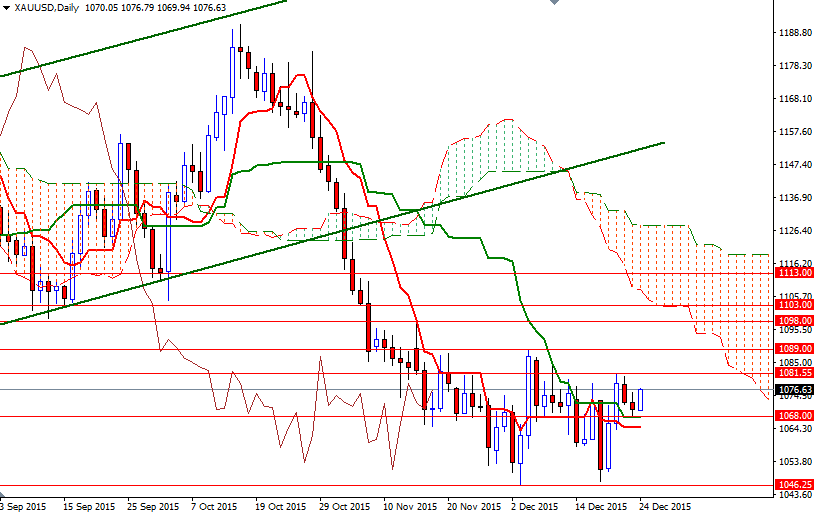

Gold settled up $6.58 at $1076.63 on Thursday, snapping a two-session losing streak, as weakness in the U.S. dollar helped increase demand for the precious metal. The ability to hold above 1068 pushed the XAU/USD pair higher as expected and consequently the resistance in the 1076.90-1075.80 zone was tested. Apparently the market is finding some support from short-covering as big investors lock in gains before the year’s end.

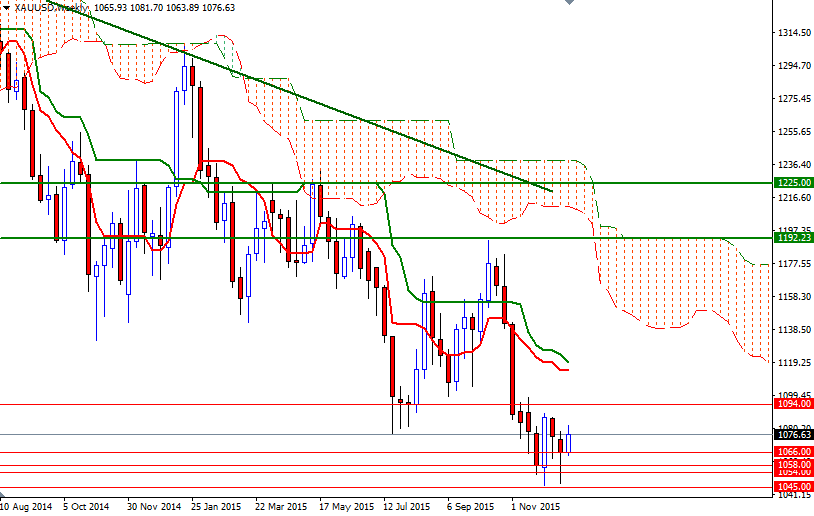

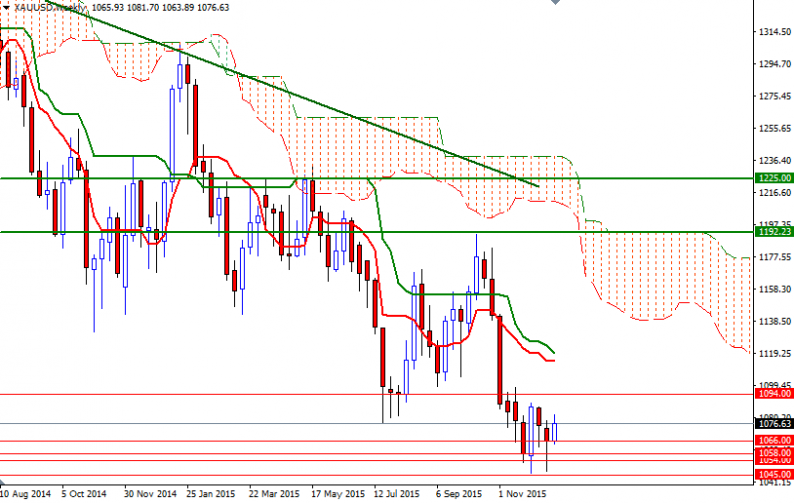

Gold has tested the support around the 1046.25 level two times this month but the cheapest prices in 6 years attracted some players expecting a bounce. However, we are still stuck within a relatively narrow range of around $45 since mid-November. The long-term technical picture for XAU/USD is still weak, with the market trading below the weekly and daily Ichimoku clouds, but short-term outlook is rather neutral. Both the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines are flat.

If XAU/USD pushes through 1076.90-1075.80 we could see a test of the 1081.55 resistance zone. Beyond that, the real challenge will be waiting the bulls in the 1089/7 area. On the other hand, if the bulls can’t push the market above 1081.55 then prices won’t have much room to go. In that case, XAU/USD could retreat to the 1068/6 region. Sellers have to drag prices back below 1066 so that they can test the next support at 1063/2. Closing below 1062 on a daily basis would imply that the bears will be aiming for 1058 afterwards.

Leave A Comment