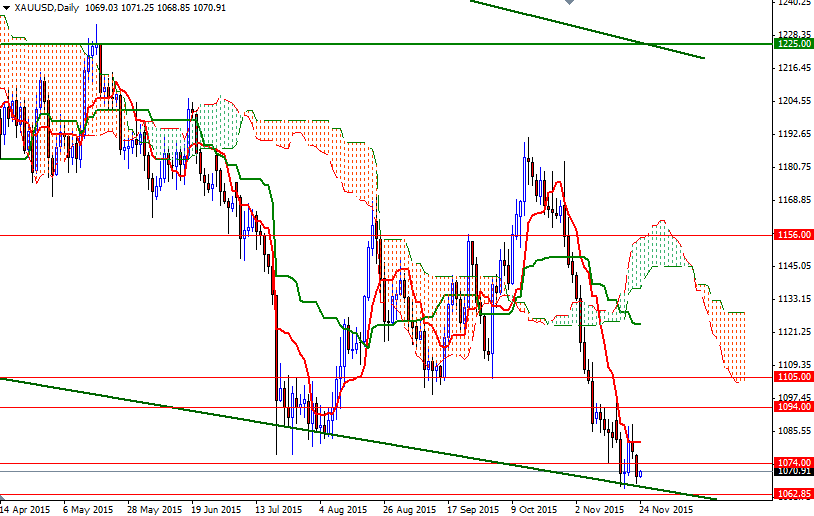

Gold prices fell $7.75 an ounce yesterday, marking the second consecutive negative session, as a stronger dollar dimmed the appeal of the precious metal as an alternative investment. The XAU/USD pair dipped to a low of $1066.69 after the $1076/4 support is breached. Speculation that the U.S. Federal Reserve will deliver a rate hike in December has intensified since the release of strong employment data earlier this month.

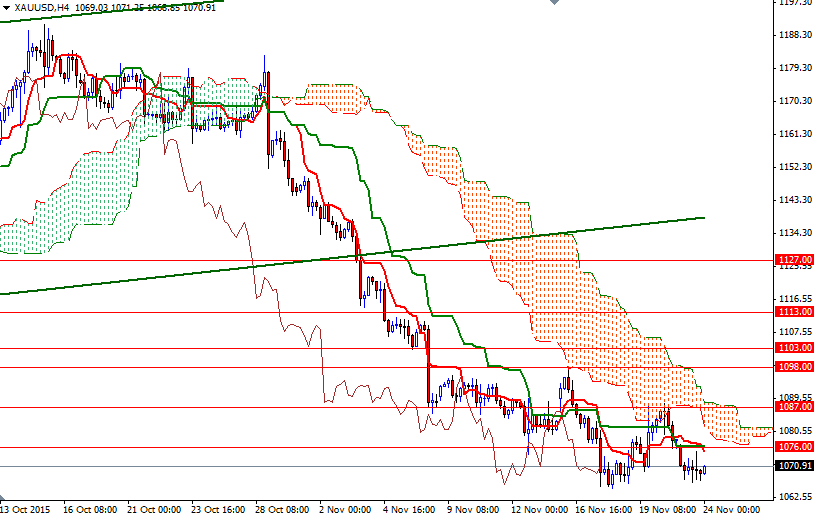

XAU/USD is trading at $1070.91, slightly higher than the opening price of $1069.03 but we still remain within the consolidation that we’ve seen for some time. Technically speaking, the weekly, daily and 4-hourly charts are bearish while prices are below the Ichimoku clouds. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines are adding some extra pressure.

To the upside, the initial resistance levels stands in the 1076/4 zone. The bulls will have to push prices back above the 1087 level, where the top of the Ichimoku cloud on the 4-hour time frame sits, at least in order to improve the technical picture. Only a daily close beyond this barrier could provide buyers the extra momentum they need to tackle the next resistance levels at 1094 and 1098. The area down below has been supportive lately but as long as the aforementioned resistance at 1087 is not surpassed, the risk of the break below 1062.85/1.55 remains high. If the XAU/USD pair drops through 1062.85/1.55, then the market will have a tendency to fall further. In that case, the bears will be aiming for 1054 and 1045.

Leave A Comment