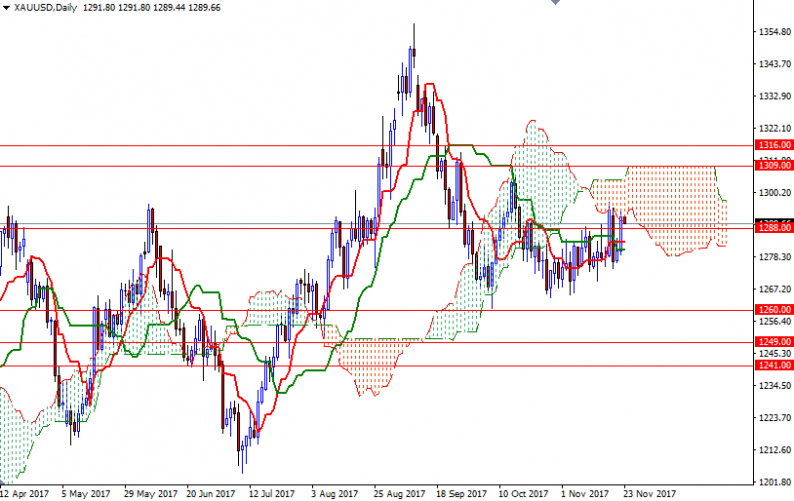

Gold prices ended Wednesday’s session up $11.41 an ounce as the dollar weakened after minutes from the Federal Reserve’s latest meeting showed some officials were concerned over the inflation outlook. “Many participants observed that there was some likelihood that inflation might remain below 2 percent for longer than they currently expected,” the Fed said in the minutes. XAU/USD tested the resistance in $1296-$1292 as anticipated after prices broke through $1288. The market has stalled in Asia ahead of the Thanksgiving holiday.

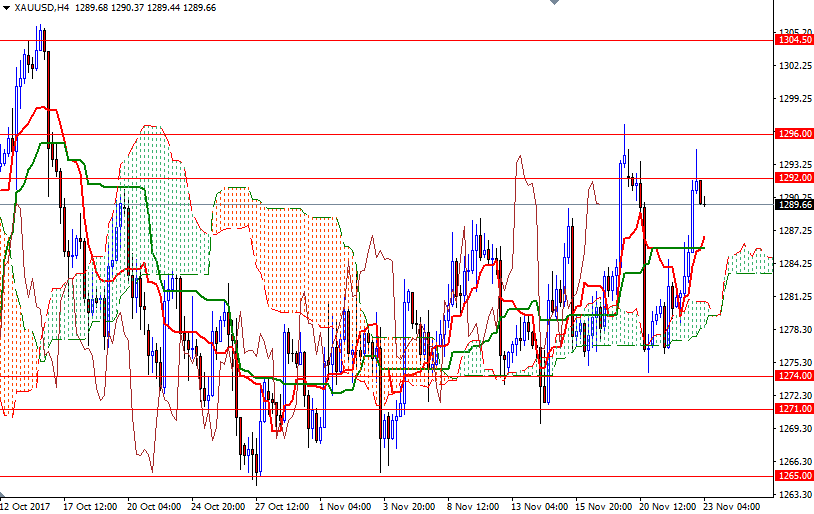

The market is trading above the Ichimoku clouds on the H4 and the H1 charts. In addition, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. The bulls have the short-term technical advantage, but the upside potential will be limited unless prices get back above the 1292 level. If this resistance is broken, the bulls may have an opportunity to challenge 1296.

To the downside, keep an eye on the support at 1288. If the bulls run out of steam and the market dives below 1288, then the next stop will be 1285.60. The bears will need to capture this camp to make an assault on 1283.50, the daily Tenkan-sen. A successful break below 1283.50 suggests XAU/USD might visit 1280.52-1280 next.

Leave A Comment