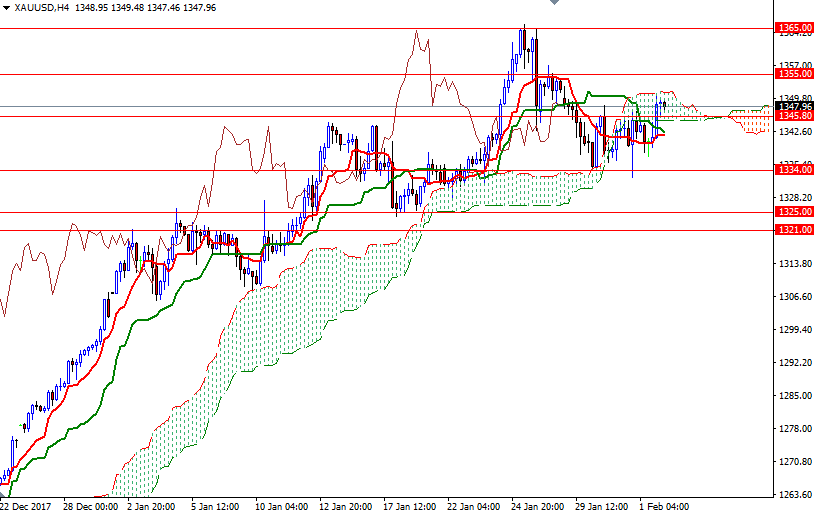

Gold prices ended Thursday’s session up $3.78 an ounce, extending gains from the previous session, as stock markets turned lower and the American dollar weakened. World stock markets were mostly weaker, pressured by rising bond yields. XAU/USD initially tested the support at $1338 but bounced up from there and broke through the $1345.80 level. Consequently, the market reached the $1351-$1350 region as anticipated. We will probably have to wait for the release of the U.S. government’s jobs report, due later today, before price get anywhere interesting.

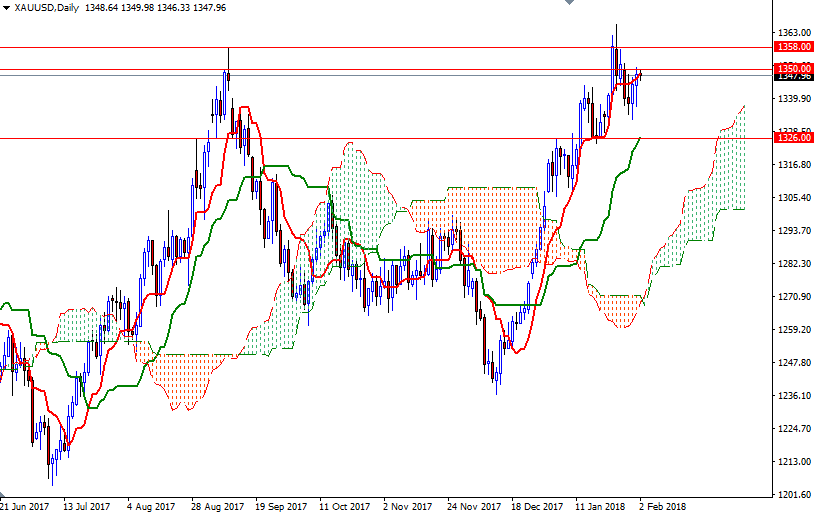

The market is currently trading above the Ichimoku clouds on the H1 and the M30 time frames, plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on both chart. However, the bulls have to push through the 1351/0 area, where the top of the 4-hourly cloud sits, to make an assault on 1358/5. A successful break above 1358 could foreshadow a move to 1365.

To the downside, keep an eye on the support around the 1338 level. If this support gives way, the market will probably head towards 1334/3. Breaking down below 1239 would open up the risk of a fall to 1326/5. The bears have to drag prices below this strategic support to challenge 1321.

Leave A Comment