Gold prices ended Wednesday’s session down $21.01 as the minutes of the Federal Reserve’s April meeting fueled a rally in the dollar. “Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June,” the minutes said.

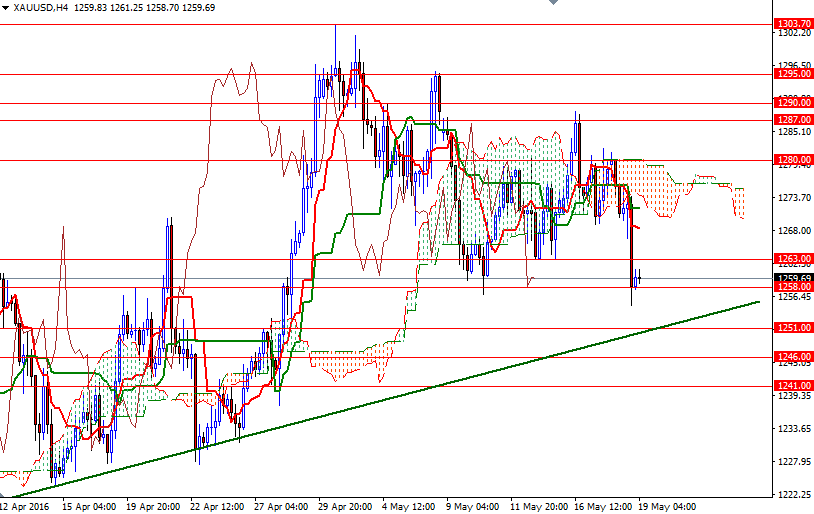

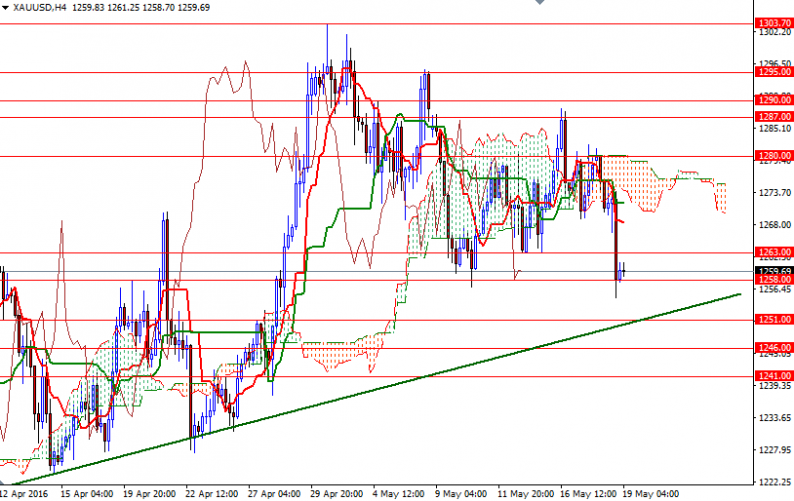

If the economy and labor market improve as they anticipate, Fed officials want to lift rates at the next meeting on June 14-15 so that they can have room to maneuver in the future. The XAU/USD pair is trading at 1259.69, slightly higher than the opening price of 1258.23. The market is trying to hold above the 1258/6 support but the short-term technical picture remains weak, with the market trading below the Ichimoku clouds on the 4-hour time frame. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines, along with Chikou Span (closing price plotted 26 periods behind, brown line)/Price cross in the same direction add to gloomy outlook.

In other words, unless the resistance in the 1264/3 is not surpassed, the risk of the break below 1256 remains high. If that is the case, keep an eye on the 1251 region where a short-term bullish trend line and horizontal support coincide. The bears have to invalidate this crucial support so that they can visit 1246 and 1241 afterwards. To the upside, the initial resistance stands at 1264, followed by 1272/69. If the bulls take over and manage to break through 1272 convincingly, we could see a continuation towards 1280.

Leave A Comment