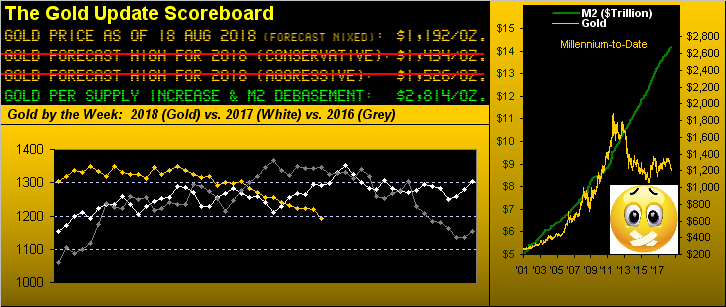

So much for the “immovable object”? Oh, the yellow metal finally got off its duff alright: but without noticing that a dastardly team of shorts had sneaked in this past week and tied together Gold’s shoelaces such that it fell flat on its face. Leaving the 1200s in the lurch, price tumbled to as low as 1167, a level not traded since January 5 a year ago. And as a calculative courtesy to those of you lucky enough to be scoring at home, back on that day some 20 months ago the “M2” money supply of the United States was $13.24 trillion: today it’s $14.17 trillion, an increase of 7.02%. In the pure vacuum of Gold’s supposed positive correlation with M2 (per the above right panel of the scoreboard), that would put price right now at 1249 … except that back on January 5, 2017 Gold “ought already have been” at 2688. And as you can see “ought” today be 2814 … except that Gold settled out the week yesterday (Friday) at 1192. Really.

“But you always say the market is never wrong…”

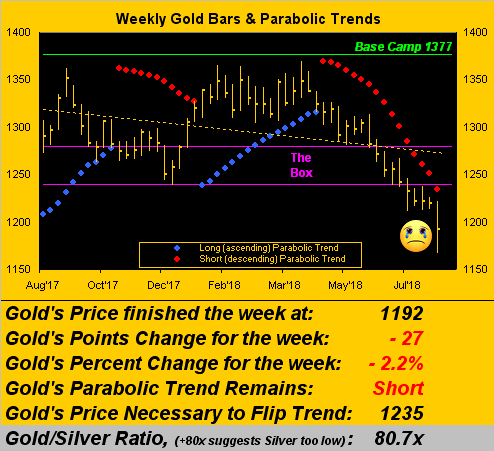

True enough: price is what it is. But you know, and I know, and all of our readers from Sheboygan to Shanghai know, that market valuations can drastically deviate from their “ought to be” levels. Look at present stock market indices’ sky-high prices versus their constituents’ earnings, (or lack thereof): that is far more worrisome than is Gold’s lowly price. For as the past forty years have proven, stock markets this lofty have always crashed, and beaten-down Gold has always robustly recovered, the latter obviously having yet to occur as we next see in the weekly bars; and note therein the inferred slamming of Silver as Gold’s ratio to silver’s price has climbed back above the rarefied rank of 80x:

Speaking of correlation, it’s positive between Gold’s fallouts and incoming email. Here are a few phrases received this past week: “I wait for gold to turn around” … “Is this the capitulation” … “Where’s the support, $500/oz.?”

Leave A Comment