Gold prices ended Wednesday’s session up 2.1%, benefiting from a weaker dollar and falling equities. The XAU/USD pair traded as high as $1109.54 an ounce after a series of economic data out of the world’s largest economy disappointed the markets. The Commerce Department reported that housing starts declined 2.5% to a 1.15 million annualized rate and the Labor Department said the consumer price index fell 0.1% in December.

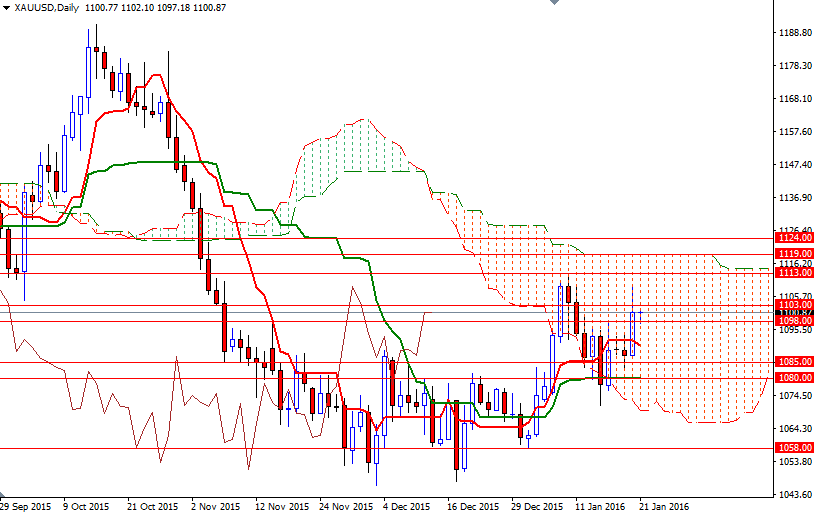

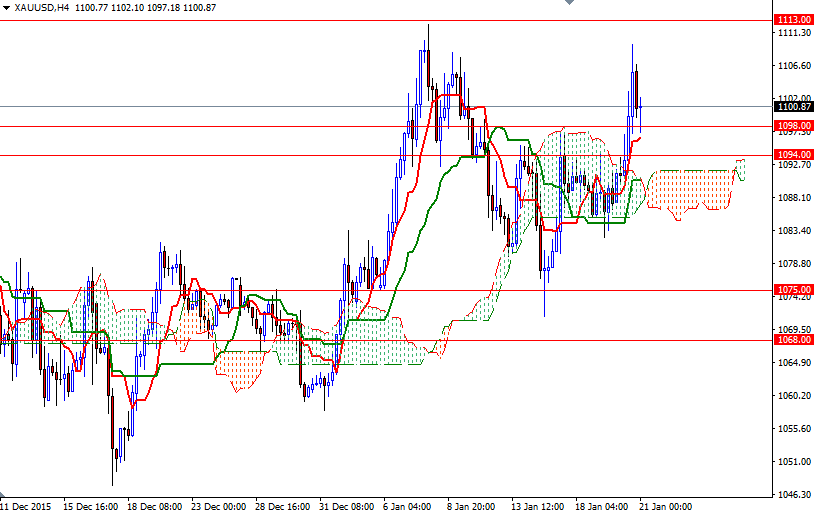

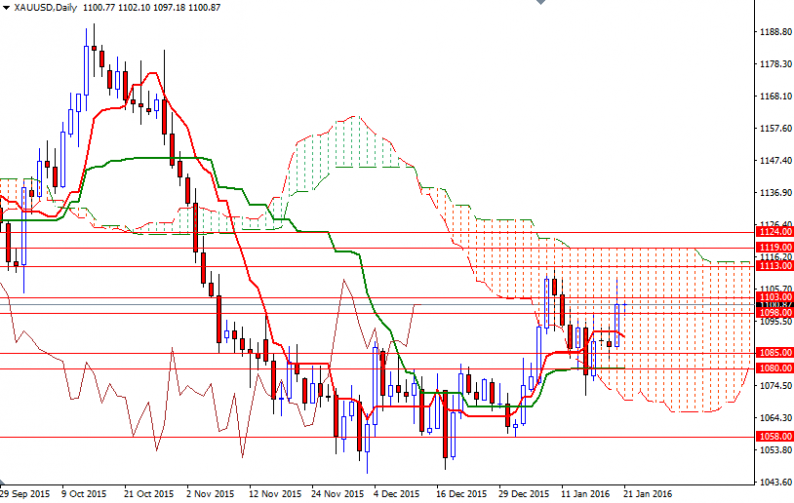

The XAU/USD pair initially tested the 1098 level (the previous resistance now flipped to support) before climbing back above 1100. Yesterday’s rally pushed the XAU/USD pair above the Ichimoku clouds on the 4-hour time frame, indicating that the short-term technical outlook for the XAU/USD pair has shifted to the upside. We also have bullish Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) crosses on both the daily and 4-hourly charts.

The market looks as if it will try to reach the 1119 level where the top of the daily cloud resides, though the bulls have to push through 1105.50-1103 in order to reinforce this theory. On its way up, resistance may be found at 1113. If the market encounters heavy resistance and drops below the 1098/7 support, then it is possible to see prices retreating to the 1094 level. Falling through 1094 could open a path to the 1091.88-1090.47 area.

Leave A Comment