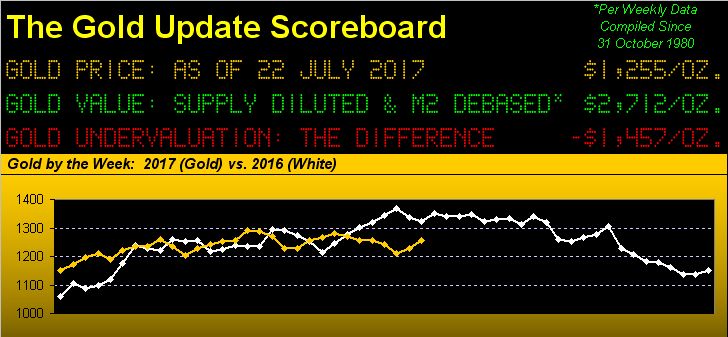

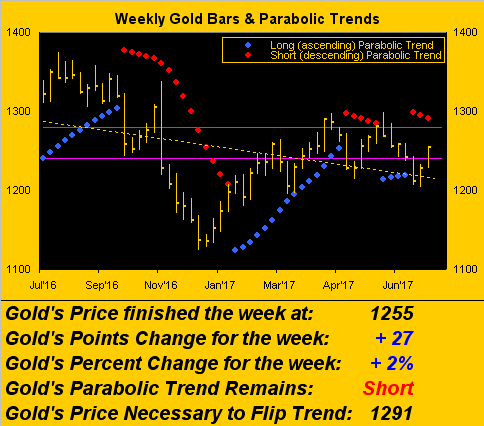

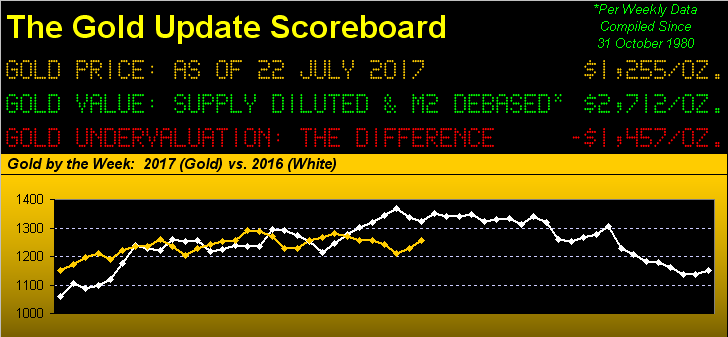

For those of you fond of the fortnight, Gold just finished its fourteenth of the year, with its third-best bi-weekly gain (+3.6%) of 2017; and this most recent week’s gain (+2.2%) ranks fourth of the 28 year-to-date, price settling Friday at 1255 … albeit that still lags where ’twas at this point a year ago (1322) as we above show. If only one could get excited about it all.

That said, whilst we are feeling a bit bulled-up on Gold getting a grip rather than going over the cliff, we nevertheless are maintaining temperance given the age old adage that change is an illusion whereas price is the truth. And truth be told, Gold’s having moved back into its 1240-1280 box is anything butexciting. Were it a film, ‘twould be entitled “A Return To Annoyance.”

“But mmb, what if price just keeps powering up through here this time?”

Squire, whilst Gold has seemingly abandoned any notion of taking advantage of that which has historically sent its price higher (i.e. currency debasement), one of the more popular drivers — that of a diving Dollar — may this time serve to wrest Gold up from its bounds of the 1240-1280 box as defined by the purple lines across the weekly bars that we next see. Note therein that price by rising is defying the parabolic trend (currently Short) for that study’s third consecutive series; should such will out, we’ll look back to see Gold likely having powered up across 1300:

Further, let’s actually take a look at the Dollar: strictly by the technical read, its key is to hold 93, as denoted by the yellow line at right in this 30-year view of the Index. Should that level fail, the three red lines then come into support consideration, at which point one would expect Gold to clearly be in power-up mode, especially should the Buck bust the 90 barrier:

‘Course, putting aside the foibles of the six similarly faux-based currencies from which the Dollar Index is calculated, what StateSide fundamentally serves to weaken the Greenback is quantitative easing. Notwithstanding that “the economy’s great” — which ’tisn’t — one indeed wonders if the Dollar has had its eye on the faltering Economic Barometer, itself having declined in eight of the past ten weeks. Here ’tis:

Leave A Comment