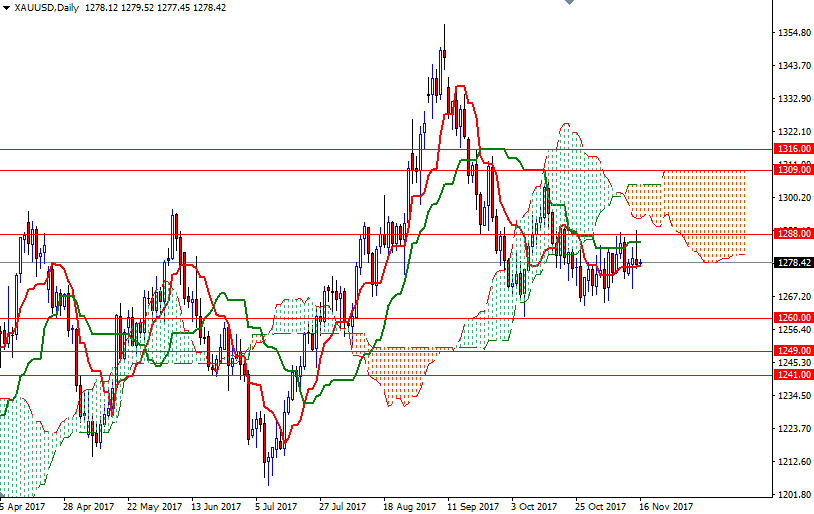

Gold prices ended Wednesday slightly lower after a volatile session. XAU/USD climbed above 1283.50 and tested the resistance around the 1288 level, but it was unable to pass through. As a result, the market returned to the Ichimoku cloud on the 4-hour chart. The yellow metal saw pressure after a report released by the Commerce Department showed that retail sales rose 0.2% in October.

XAU/USD is currently residing within the borders of the 4-hourly cloud and it is still in a sideways trading range. We have a bullish Tenkan-sen (nine-period moving average, red line) – Kijun-sen (twenty six-period moving average, green line) cross on the H4 chart. However, the market continues to feel pressure from the daily cloud and negatively aligned Tenkan-sen and Kijun-sen.

The bulls have to push prices above the intra-day resistance at 1281, the top of the cloud on the H4 chart, to revisit 1283.50. The short term charts suggest that a retest of 1288/7 is likely if this barrier is broken. On the other hand, if prices fall below the 4-hourly cloud, keep an eye on the 1274 level. A break below the 1274 level could see a fall to 1271. Diving through 1271 could trigger further weakness and a sell off to 1267/5.

Leave A Comment