Ok, so this is worth noting as we head into September.

Gold is on pace for its best monthly gain since February as investors have sought safety amid escalating tensions on the Korean peninsula and as the political situation in the U.S. continues to deteriorate, raising the specter of a shutdown or a technical U.S. default (and before you go calling the latter hyperbole, just take a look at who’s in the Oval Office).

Of course these haven bids come and go faster than a communications director at the White House, and as Metals Focus analyst Junlu Laing noted overnight, “without any further serious escalation, the yellow metal has already retreated from its 9-month highs.” Right, and PCE and NFP loom large on the horizon.

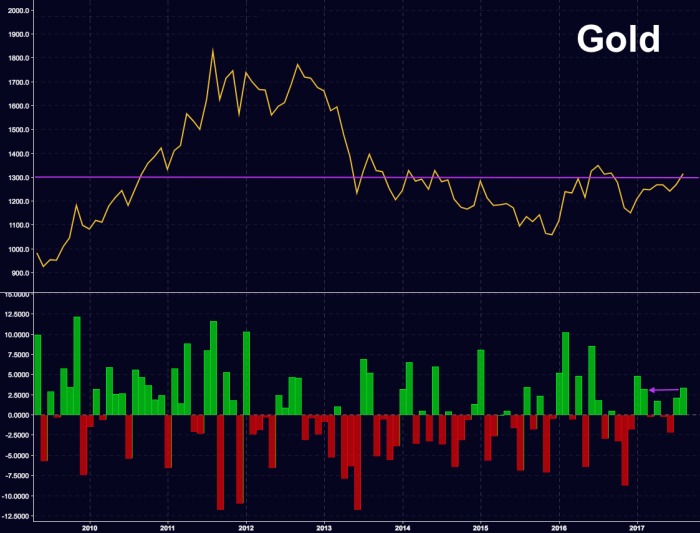

In any event, it’s been a decent month and we’re still above $1,300:

For his part, OCBC economist Barnabas Gan thinks the geopolitical risk premium isn’t going to completely vanish in the near-term. “Bullion will remain above $1,300/oz for some time, barring a quick resolution to the situation in North Korea following missile firing across Japan,” ol’ Barnabas said, in a note dated today.

He does go on to note that polished doorstops should “trend lower into 4Q” assuming there’s another Fed hike. “Better growth prospect into 2018 should translate into more risk-taking and yield- chasing,” Gan goes on to say, adding that “safe-haven demand, especially for gold, should invariably trend lower with end-2018 target at $1,100/oz.”

Whatever. Who the fuck knows.

What we do know is that Mohamed El-Erian has some thoughts on why shiny paperweights might be losing their appeal as a haven. You can read his reasoning below but do note that Josh is definitely not amused with “shockingly-uninformed” Mohamed:

Shockingly-uninformed #gold analysis by @elerianm

..Mr Dalio called for “excellent analysis”, not same ol’ hubris

https://t.co/XYRfwRjUKM

— Josh Crumb (@JoshCrumb) August 30, 2017

Leave A Comment