Gold prices rose $12.06 an ounce on Thursday after the Fed’s preferred inflation gauge remained below its annual target and the latest housing data came in weaker than expected. The Commerce Department reported that consumer prices grew 0.1% in July from a month earlier and 1.4% over the past year. The National Association of Realtors said its pending home sales index fell to 109.1 in July from a downwardly revised 110.0 in June.

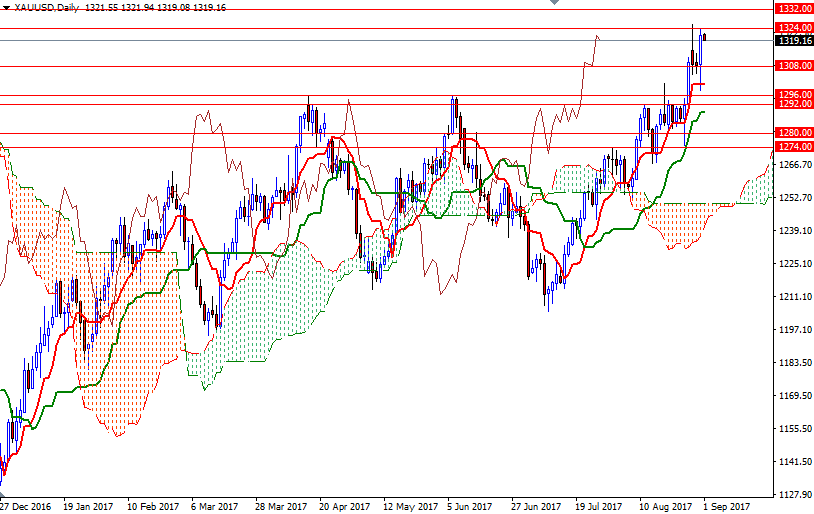

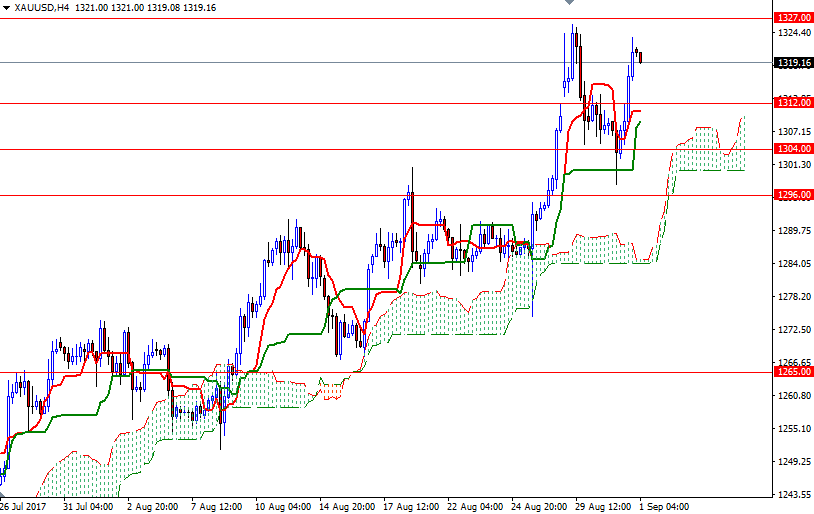

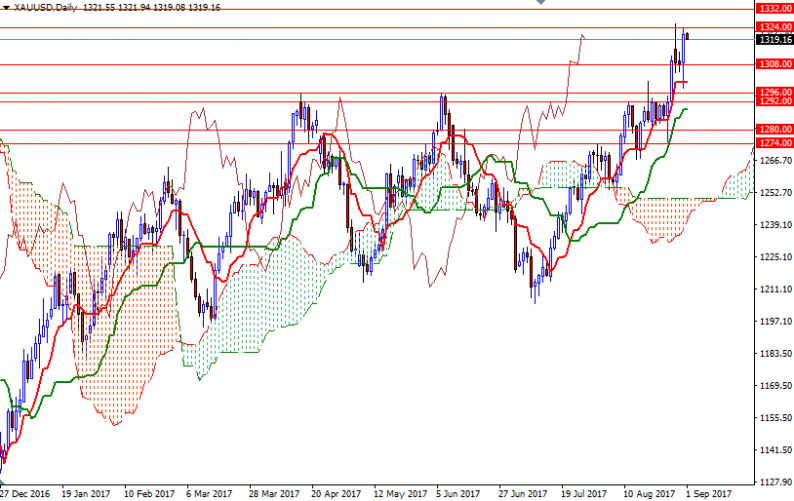

Technical buying was also behind gold’s 0.92% jump yesterday. XAU/USD was able to cleanly break the resistance in the 1313.45-1312 zone and as a result, the market ended up challenging the first significant barrier in 1327.50-1324. Today’s non-farm payrolls report won’t make much difference to the U.S. central bank (as its policy depends on the overall trend father than a single report), though the market participants will probably be hesitant to add new positions ahead the release.

If the aforementioned resistance in the 1327.50-1324 area is broken, look for further upside with 1332 and 1337.16 as the next targets. The bulls have to produce a daily close beyond 1337.16 to set sail for 1342. To the downside, keep an eye on the 1312 level. If XAU/USD falls through 1312, then it is likely that the market will test the support at 1308, or perhaps 1304. Below there, the 1296/2 area stands out as a crucial support and the bears will need to capture that camp to tackle 1288/5.

Leave A Comment