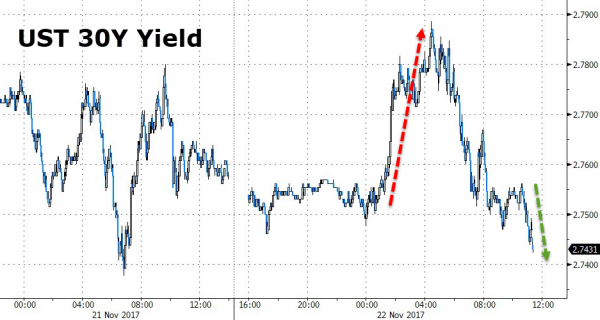

The dollar index had been falling in early trading – extending its free-fall from the Nov 1st Fed statement – but legged down on the dovish minutes to the lowest in 5 weeks. Gold is extending its gains, above key technical levels and while the curve is steady, long-end bond yields are sliding modestly.

Today is the worst day for the dollar index since Sept 7th…

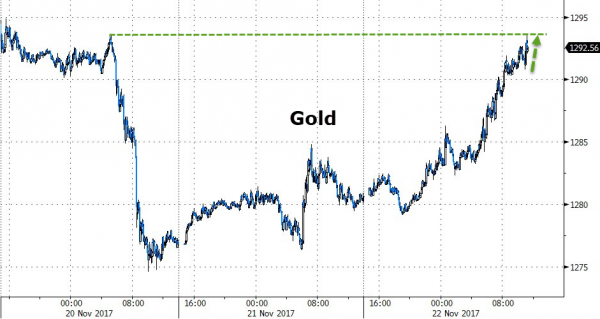

And Gold has erased its plunge from Monday…

Early weakness in bonds has been entirely reversed…

For now the machines have not figured out how to kick stocks higher…

Leave A Comment