OK – so, China tightens (worried about leverage), European sovereign risk spikes (Election uncertainty everywhere), Yen surges (BOJ tested again), gold spikes, Treasury yields tumble.. but US stocks are flat and VIX tumbles…

Off the post-Fed-rate-hike dip, Gold is up almost 10%, Dow’s flat, and bonds are up…

Chinese stocks sank overnight after re-opening following the Golden Week holiday (and after China quietly raised rates)…

European election uncertainty is starting to creak into risk assets…

and quietly behind the scenes, debt ceiling concerns are growing…

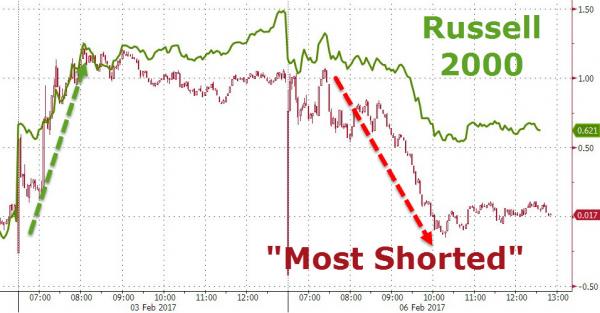

Friday’s short-squeeze was unwound…

Stocks gave back some of their Dodd-Frank-is-Dead exuberance today, but held on to some gains… (Trannies and Small Caps were worst performers today). All major indeices closed red today (snapping a 3-day win streak for the S&P…

The Dow opened at 20,002 and VIX was immediately crushed to ensure 20k was protected – but once Europe closed, things turned lower…

As even banks gave some back (but again remain the best performers off the payrolls print)…

Treasury yields plunged today – erasing all of Friday’s sell-off…with yields below Friday’s payroll lows…

Bonds and stocks decoupled…

The USD Index pumped and dumped today to end unchanged (but Yen was the biggest gainer)…

Gold (and Silver) surged back towards pre-election levels…

And USD/JPY finally smashed through its 112.00 support – mirroring the gold move…

Crude is the notable laggard post-payrolls… (post-rig count)

Gold broke above its 100DMA…

Leave A Comment