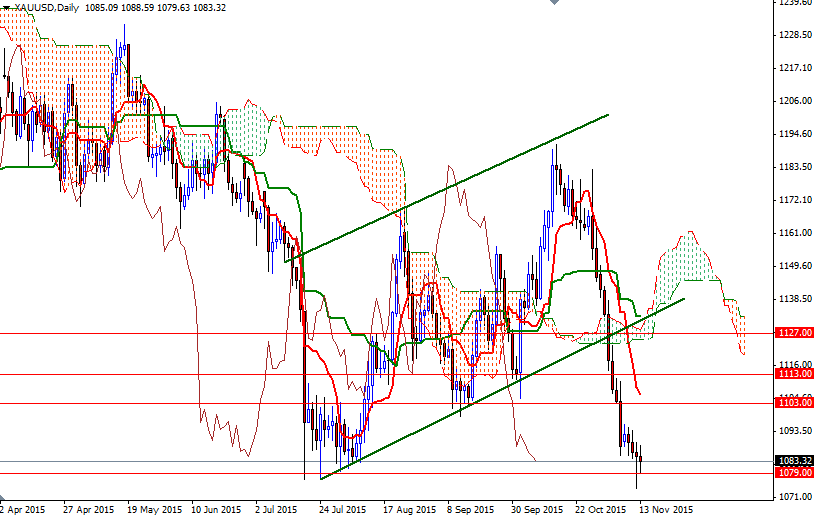

Gold prices settled at their lowest level since February 2, 2010, recording a fourth consecutive weekly loss, as concerns over the prospects of rising U.S. interest rates and technical selling pressure persisted. At the beginning of the week, the XAU/USD pair initially rose but the resistance at the $1096 level prevented the market from going higher and attracted short traders.

The pattern on the charts suggests that there is just no real interest in the market to own gold. Gold plunged more than %8 in the past four weeks and returned to the critical 1076/4 area where the market found enough support to reverse back in July. This area produced only a slight bounce so far and therefore without a strong sign, it might be a little early to call a bottom. We need to get down below there successfully in order to continue to trend downwards. If that happens, the XAU/USD pair could all drop the way down to about 1045. On its way down, support may be found at 1062.85.

However, it would not be surprising if prices stalled ahead of inflation data and minutes of last month’s Federal Reserve policy meeting. The argument for altering the monetary policy sooner was bolstered by the government’s latest jobs report, which showed a strong performance from the labor market. In the meantime, keep an eye on global stock markets which experienced sharp declines very recently. The return of instability to equities may offer upside potential for gold. If the 1076/4 support holds, it is likely that XAU/USD will march towards the 1096 level. Beyond that, there are obvious resistance levels at 1105/3 and 1113 but this whole area is occupied by the 4-hourly Ichimoku cloud so breaking through could be more troublesome than expected.

Leave A Comment