The price of gold dropped abruptly Friday morning (Arizona time). How much of a drop? $10.30, as measured by the bid on the December future. How abruptly? That move happened in under a second.

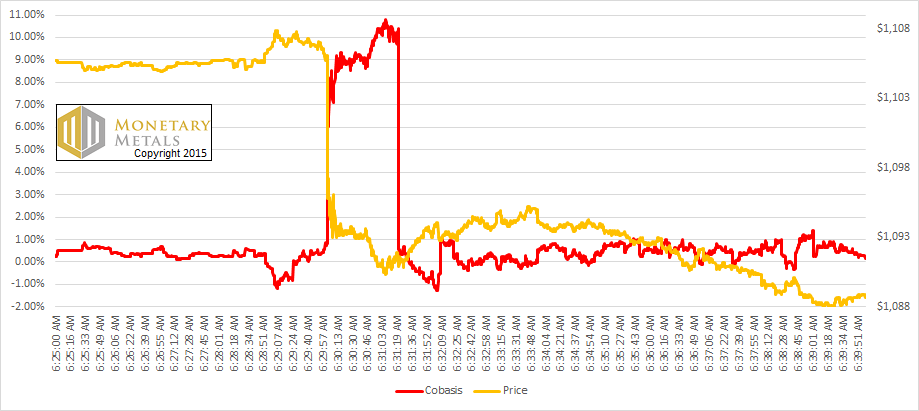

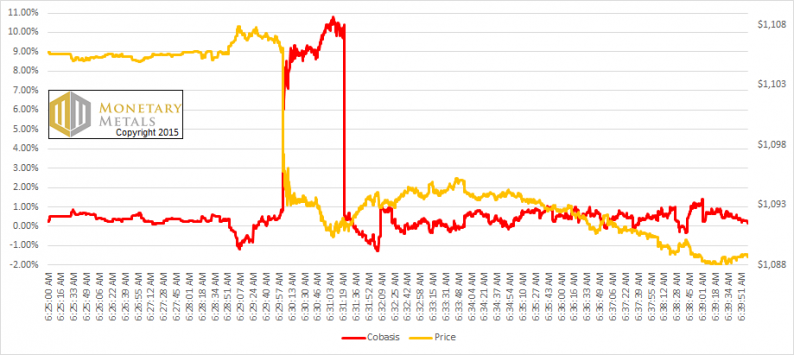

At first, the price of gold in the spot market did not react. This caused what looks like a massive backwardation (recall that the cobasis = Spot(bid) – Future(ask)—if the future drops relative to spot, that is backwardation). See the graph of price overlaid with the Dec cobasis.

The cobasis briefly hits a peak around 11% (from its “normal” level, currently in temporary backwardation, around 0.5%).

The whole cobasis spike is over 79 seconds later. The spot price is finally updated and the giant apparition of backwardation is banished.

We are not London bullion market insiders. However, we would bet an ounce of fine gold against a soggy dollar bill that this backwardation was not actionable. That is, it represents a delay in updating a quote rather than an offer to let you decarry your gold and pocket nearly $17 an ounce (we would love to hear stories to the contrary).

There are enough serious problems with the dollar, and the gold market is hardly in a state that could be called normal. So let’s not make this molehill into a mountain. One commentator asserted that the spot market did not “believe” the futures price.

The fact is that the event began in the futures market. It propagated to the spot market subsequently. Attributing motives is just guessing. Attributing it to manipulation is just making up ghost stories around the campfire.

Leave A Comment