Gold is currently trading in excess of $1200 an ounce. This is well above the 1980 all-time high. However, this is an incomplete representation of what gold is trading at relative to US dollars. When you look at the gold price relative to US currency in existence, then it is at its lowest value it has ever been. This is an example of how paper assets are completely out of tune with tangible (real assets).

The US monetary base basically reflects the amount of US currency issued. Originally, the monetary base is supposed to be backed by gold available at the Treasury or Federal reserve to redeem the said currency issued by the Federal Reserve. The Federal Reserve does not promise to pay the bearer of US currency gold anymore; however, it does not mean that gold (it’s price and quantity held), relative to the monetary base has become irrelevant.

When the US monetary base gets too big relative to the gold price (& US gold reserves), then market forces seek to correct the situation. This has happened a number of times over the last 100 years, but on two occasions, it was so critical, that the situation actually over-corrected. This was during the 30s and the 70s.

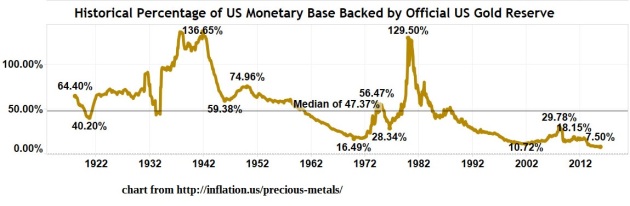

Below is a chart from inflation.us, which illustrates this:

It shows the extent to which the US monetary base was backed by the official US gold reserves over the last century. Note that even under the gold standard, US currency was not fully backed by gold.

One can see the two occasions (1933 & 1970) when the lack of gold backing became so critical that the gold price corrected to a situation where US gold backing actually became more than 100%.

What differentiate these two occasions from other times when the ratio of US gold backing was also low (like 1921, for example), is the timing relative to economic conditions. The low level of gold backing in 1933 came after a period of massive credit extension (the roaring 20s), and a few years after the Dow’s 1929 peak. At that time (post 1933) the economic conditions were such that the ability to extend credit was severely limited, due to the excesses caused by the credit extension during the 20s. This led to reduced economic activity over the following years.

Leave A Comment