Gold prices ended Monday’s session nearly unchanged as the dollar remained firm on worries over the escalating trade conflict between the United States and China. U.S. President Donald Trump is planning to impose new import tariffs on Chinese goods later this week. President Trump’s threats to leave Canada out of the new trade pact weighed on global stock markets yesterday. U.S. economic data will be in focus this week as investors look for clues on the pace of future interest rate hikes.

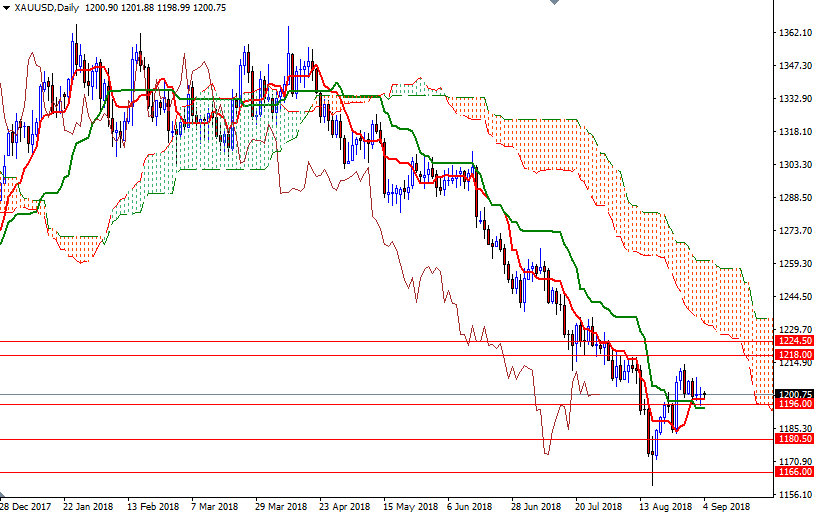

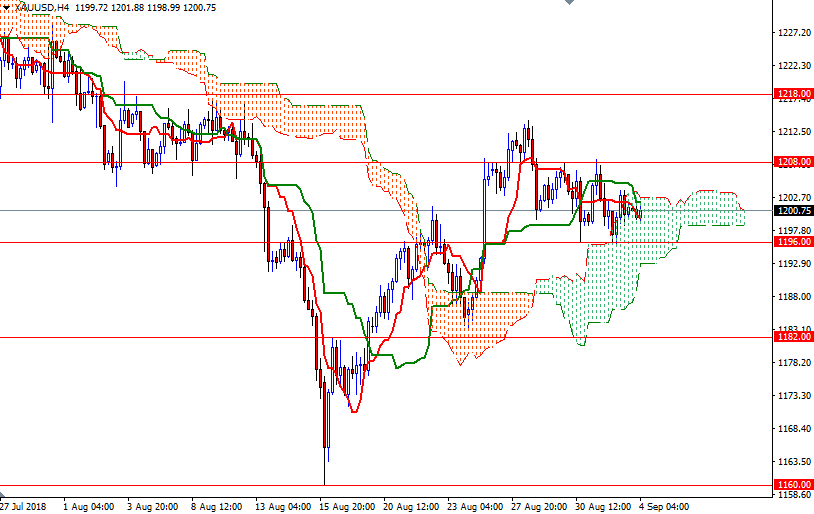

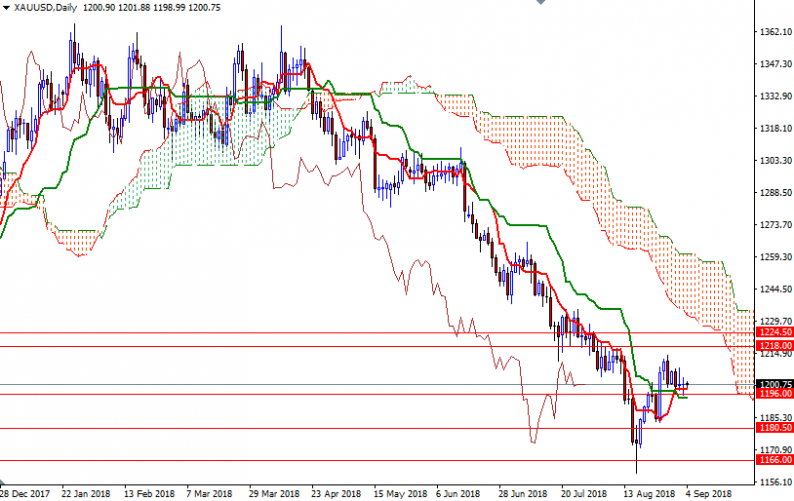

The upside for XAU/USD will likely be limited, with the market trading below the Ichimoku clouds on both the weekly and the daily charts. Lately, gold prices have been continuously held in check by a technical resistance at 1208 while buying interest near the 1196 level put a floor in trading range. If prices drop below the 1196/5 area, the bears will have a chance to make an assault on 1192/1. A break below 1191 could trigger a move down to 1186. Below there, the 1282-1180.50 area stands out as a strategic technical support.

The bulls, on the other hand, have to lift prices above 1208 to make a run for 1214-1212.40. If this resistance is broken, it is likely that the market will test the 1218 level. A break through there brings in 1226-1224.50. The bulls have to produce a daily close above 1226 to challenge the next barrier in the 1238/5 zone.

Leave A Comment