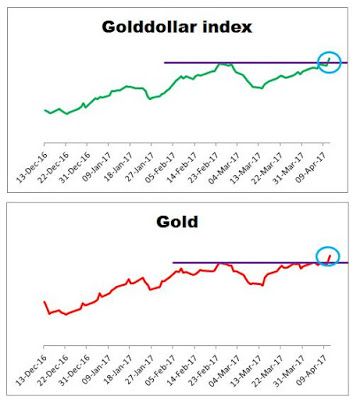

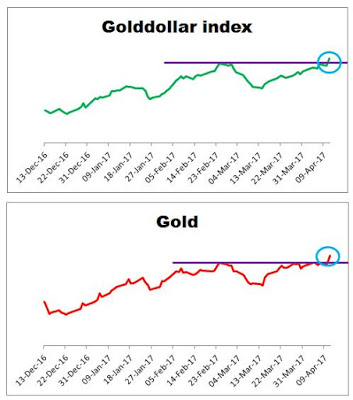

Today gold broke above its strong resistance at around $1,250 – $1,260 per ounce. The importance of this move has been additionally confirmed by other measures. Let me start from the golddollar index:

To remind my readers:

“The GolDollar Index was invented by Tom McClellan (of McClellan Financial) and is calculated by multiplying the price of gold by the U.S. Dollar Index. Its purpose is to cancel the effects of currency fluctuations on the price of gold. By comparing it with the spot gold index we can determine if there is inherent strength/weakness in the price of gold”

The blue circles are indicating today’s breakout – note that the gold and the golddollar index did the same (they broke above their resistance marked in violet).

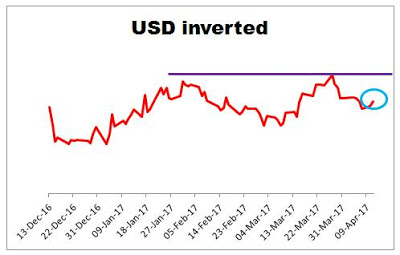

Another picture:

This time it is the inverted US dollar index chart. As a rule, gold and the inverted US dollar index go in tandem. If something different happens it may be an indication of the relative strength of gold or the inverted US dollar index. The chart shows that now gold is much stronger than the inverted US dollar index (note that gold is above its strong resistance but the inverted US dollar index is not).

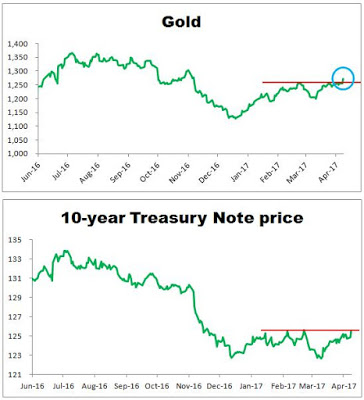

Another graph:

Now it is gold against 10-year US treasury notes prices. I believe that 10-year US treasury notes are a good proxy for real interest rates (excluding inflation).

Lower real interest rates (and higher prices of US treasury notes) support higher prices of gold. So, as a rule, gold prices go in tandem with the prices of treasuries. However, as the chart shows, gold is once again stronger than treasuries – it did break above its strong resistance while the prices of treasuries did not.

Summarizing – gold is very strong now. Its price goes up without bothering about the US dollar. What is more, it is also stronger than US treasuries so it looks like we are ahead of another rally in gold…

Leave A Comment