Gold prices dropped on Wednesday, marking the first loss in four sessions, as a stronger dollar and gains in equity markets sapped demand for safe havens. XAU/USD is trading at $1132.53, slightly lower than the opening price of $1133.65.

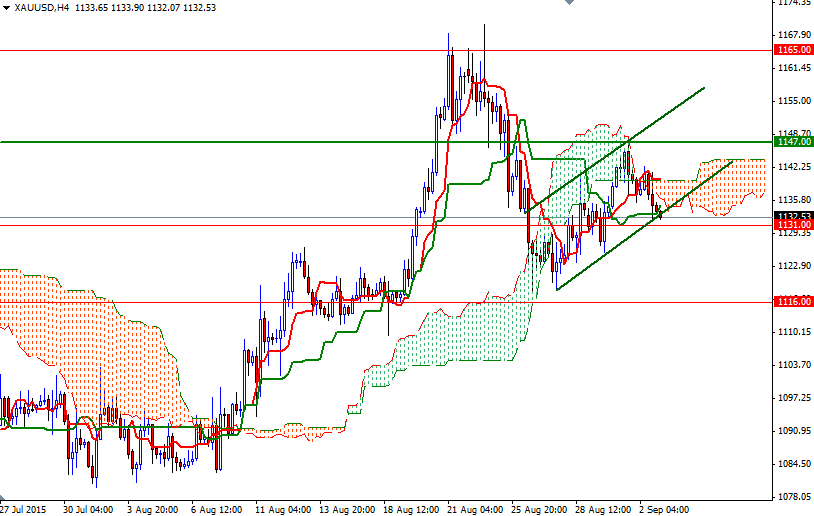

The market has been stuck roughly between the 1147 and 1116 levels since last Tuesday and it appears that investors are hesitant to put larger bets ahead of the Labor Department’s monthly non-farm payrolls report on Friday, which will be the last one before the Federal Reserve meets on September 16-17.

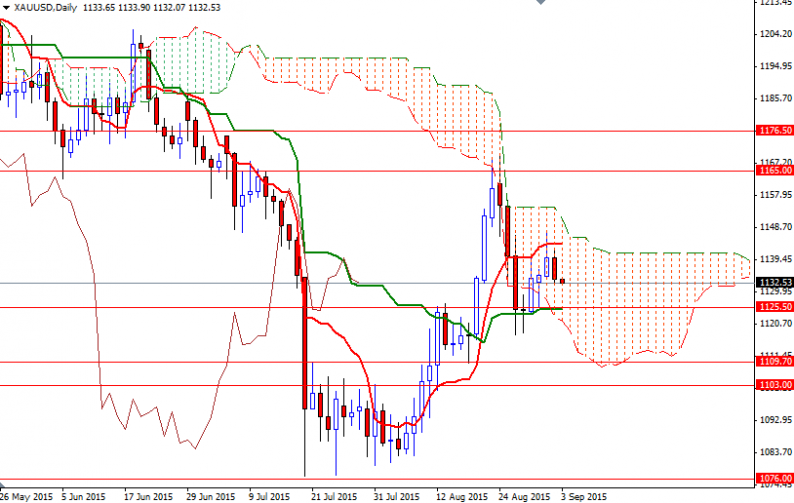

Technically, moving inside the Ichimoku cloud on the daily time frame suggests that the short term trend is flat and the pair is looking for a direction. In other words, it is likely that the XAU/USD pair will be trapped between the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines until the market builds up enough momentum to break out either way. From an intra-day perspective, I think resistance to the upside will be found at 1140 and support can be seen at 1131. If the market dives below 1131, the XAU/USD pair might retreat towards the 1125.50 – 1122.50 area. Eliminating this support would imply that the bears will be targeting 1116 afterwards. However, if the bulls take over and push prices back above 1140, we might test the 1143 and 1147 levels. Beyond that, the next challenge will be waiting the bulls in the 1155/2 zone.

Leave A Comment