Gold prices fell $15.18 an ounce on Monday, erasing last week’s gains, as investors fled to the safety of the U.S. dollar. World stock markets were mostly weaker yesterday. Last week’s spike in U.S. Treasury yields continued to weigh on stocks. XAU/USD was also pressured by worries about gold demand coming out of China.

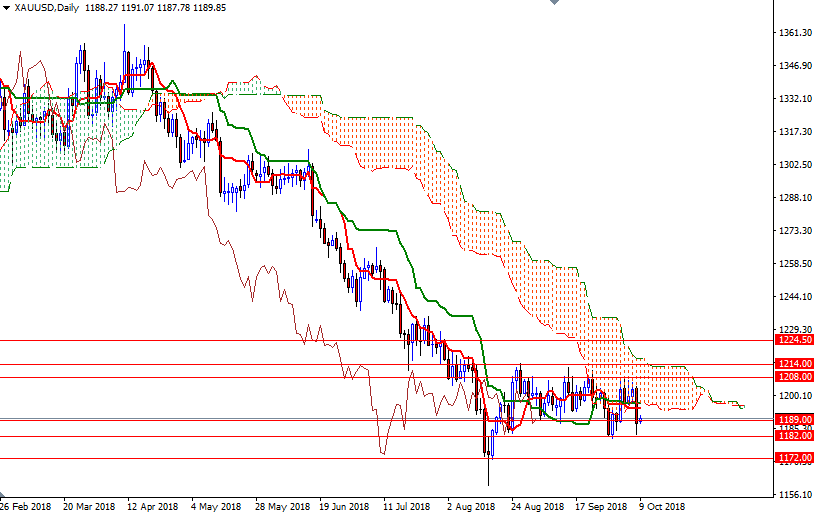

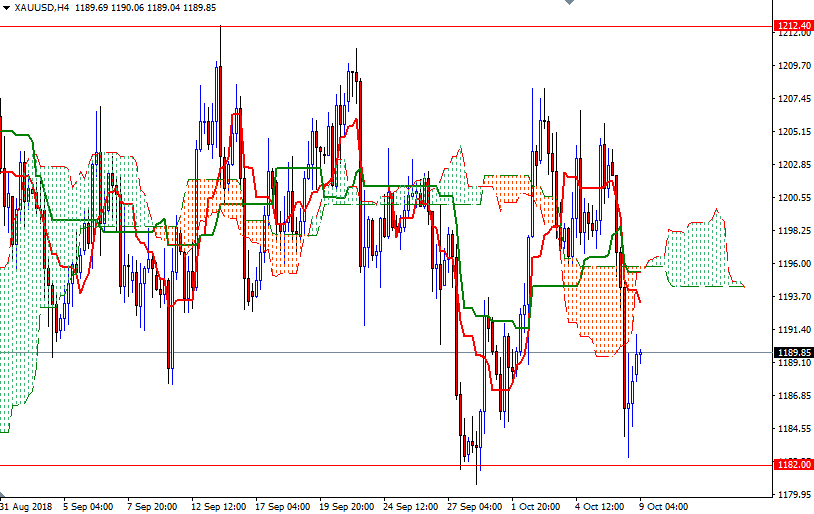

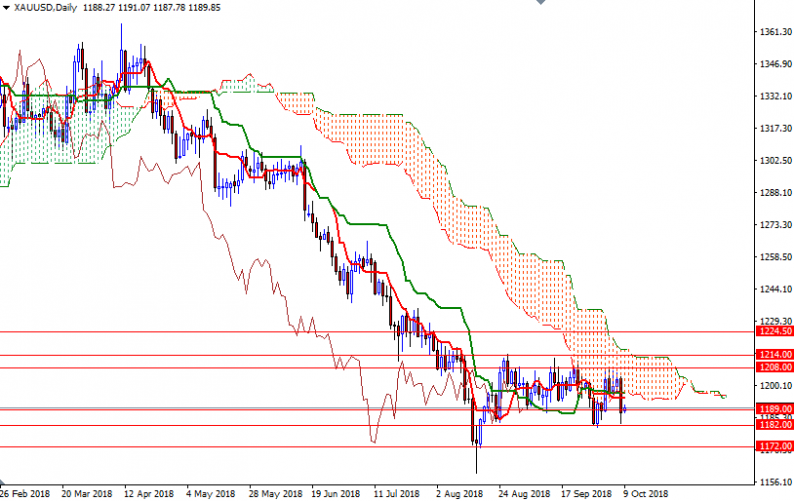

The key technical levels remains unchanged as prices are still stuck within a well-defined range without any significant momentum. The area at 1182 has acted as a strong support again and pushed XAU/USD to the 1191/89 area. If the market confidently gets back above this area, we may continue to grind higher towards 1197/4, the confluence of the bottom of the daily cloud and the daily Tenkan-sen (nine-period moving average, red line). The bulls have to lift prices above 1197 to challenge the next barrier in 1202/0.

However, if XAU/USD drops below 1189, keep an eye on the intra-day support at 1187.40. A break below 1187.40 suggests that we are heading back to 1185/4. The bears have to produce a daily close below 1182/0 to gain momentum. In that case, look for further downside with 1173/2 and 1166 as targets.

Leave A Comment