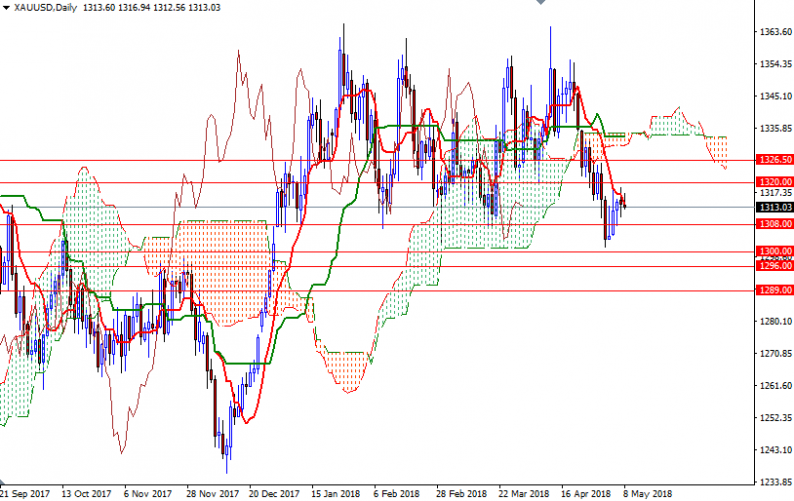

Gold prices ended a two-sided trading session slightly lower on Monday as the U.S. dollar advanced against the euro after a report showed that German factory orders dropped. XAU/USD initially made a move towards the $1320 level but the Ichimoku cloud on the H4 chart acted as resistance as expected and sent prices down. Major U.S. stock indexes rose slightly yesterday, led by shares of technology companies. Dallas Fed President Robert Kaplan and Atlanta Fed President Raphael Bostic said they were sticking with an outlook for two more interest rate hikes this year.

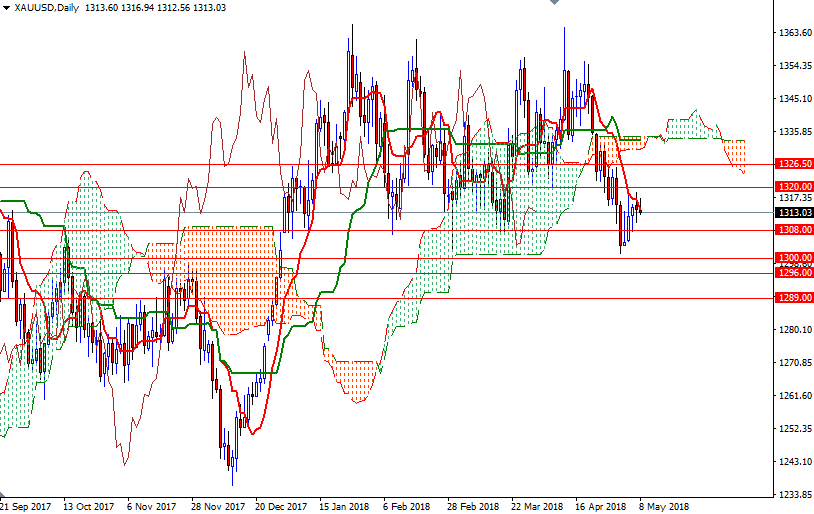

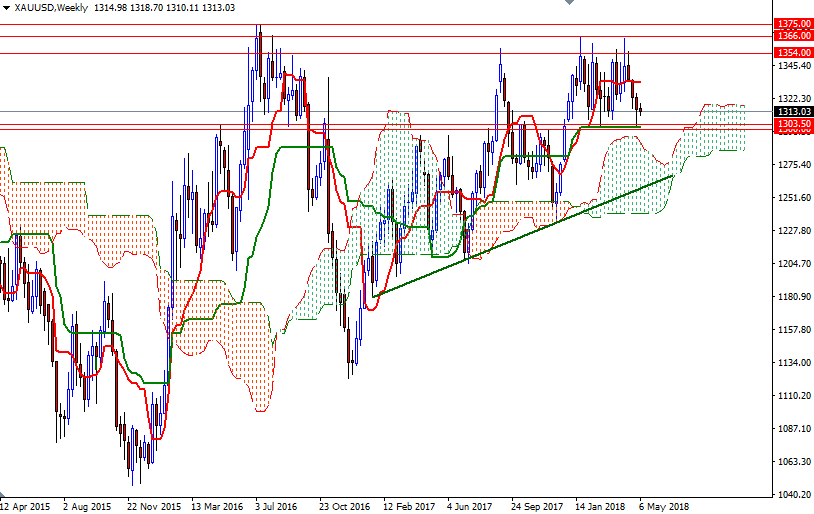

The market continues to trade below the daily and the 4-hourly clouds, suggesting that the bears have the near-term technical advantage. It appears that XAU/USD will revisit the intra-day support at 1310. If this support is broken, prices will get back to the 1308/6 zone. Breaking below 1306 would pave the way for a test of 1303.50. Below there, the 1300-1296 area stands out as a key technical support.

The 4-hourly Ichimoku cloud resides right on top us and the bulls have to lift prices above 1322/0 to gain momentum for 1326.50-1325.60, where the top of the cloud sits. A break through there could foreshadow a move to the daily cloud. The bulls have to produce a daily close above 1336/4 if they intend to tackle the next barrier at 1341.

Leave A Comment