April’s US CPI report looms large for commodity prices. The headline inflation rate is expected to tick higher to a year-on-year rate of 1.1 percent, the highest in four months. The core measure excluding energy and food prices is seen edging slightly lower to 2.1 from 2.2 percent in the prior month.

Perhaps most significantly, the spread between headline and core inflation reading is forecast to drop to a three-month low of 1 percent. This may offer support to Fed officials’ argument that transitory headwinds holding down price growth will dissipate, paving the way for further interest rate hikes.

An outcome encouraging a hawkish shift in Fed policy bets is likely to send gold prices lower amid ebbing demand for anti-fiat and non-interest-bearing assets. Crude oil prices may likewise turn lower as worries about the negative implications of greater stimulus withdrawal on global growth dynamics stoke risk aversion.

What does FXCM traders’ gold positioning say about the trend from here? Find out here!

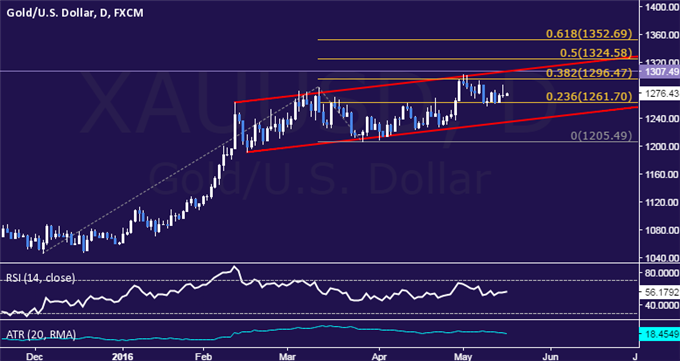

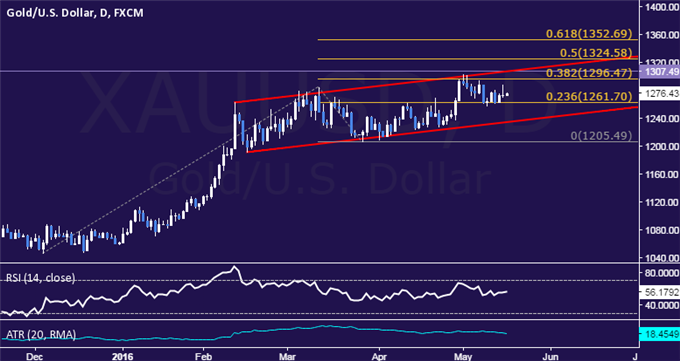

GOLD TECHNICAL ANALYSIS – Gold prices are struggling to find directional conviction, oscillating in a narrow range below the $1300/oz figure. A daily close below the 23.6% Fibonacci expansion at 1261.70, targets channel floor support at 1234.27. Alternatively, a move the 1294.26-1307.49 area (January 22 2015 high, 38.2% level) exposes the 50% Fib at 1324.58.

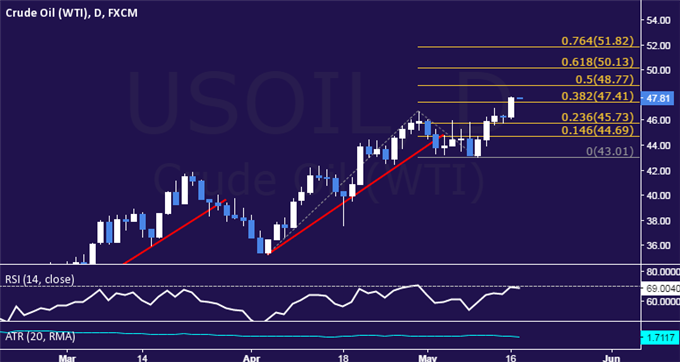

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices overturned signs of topping near April’s swing high, pushing sharply higher to post the strongest daily advance in three weeks. Near-term resistance is now at 48.77, the 50% Fibonacci expansion, with a daily close above that exposing the 61.8% level at 50.13. Alternatively, a reversal back below the 38.2% Fib at 47.41 targets the 23.6% expansion at 45.73.

Leave A Comment