Gold prices are moderately up in early trading Thursday after the Federal Reserve left interest rates unchanged. “The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace in the medium term and labor market conditions will remain strong. Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced,” the Fed said in its statement, suggesting no rush to tighten aggressively.

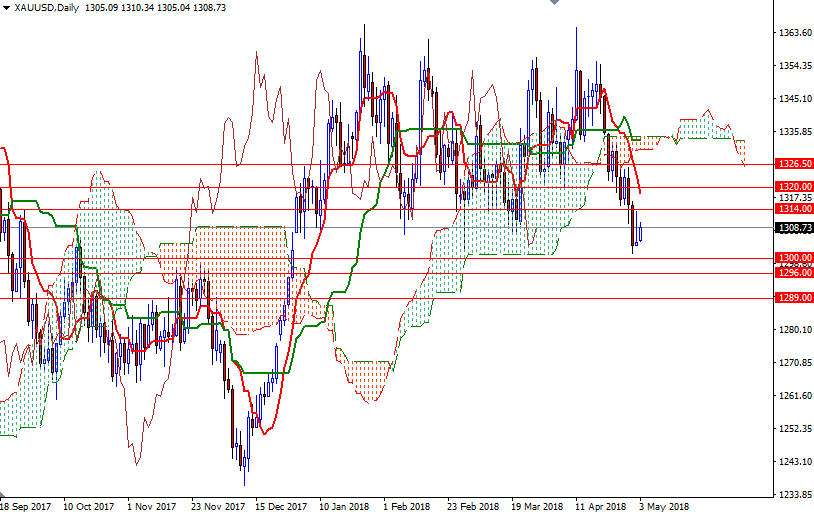

From a chart perspective, trading below the Ichimoku clouds indicates that the bears still have the short-term technical advantage. We also have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on both the daily and the 4-hourly time frames. In other words, it is likely that XAU/USD will remain under pressure. However, the key support down below in the 1300-1296 area remains untested and intact. The short-term charts indicate a retest of 1315/4 is in the cards. Passing through this area would suggest an extension to 1322/0. The bulls have to produce a daily close above 1322 to challenge the bears waiting in the 1326.50-1325.60 region.

To the downside, the bears will need to clear the intra-day support at 1303.50 to tackle 1300-1296. A sustained break below 1296 implies that lower prices will come. In that case, look for further downside with 1292-1289 and 1285/2 as targets.

Leave A Comment