Gold prices ended Tuesday’s session up $6.66 an ounce as a weaker U.S. dollar gave the precious metal a boost. The dollar’s slide is pushing investors back into gold, but the upside potential may be limited ahead of key economic data. Traders are now awaiting consumer price index and retail sales data. XAU/USD is currently trading at $1334.82 an ounce, higher than the opening price of $1329.31.

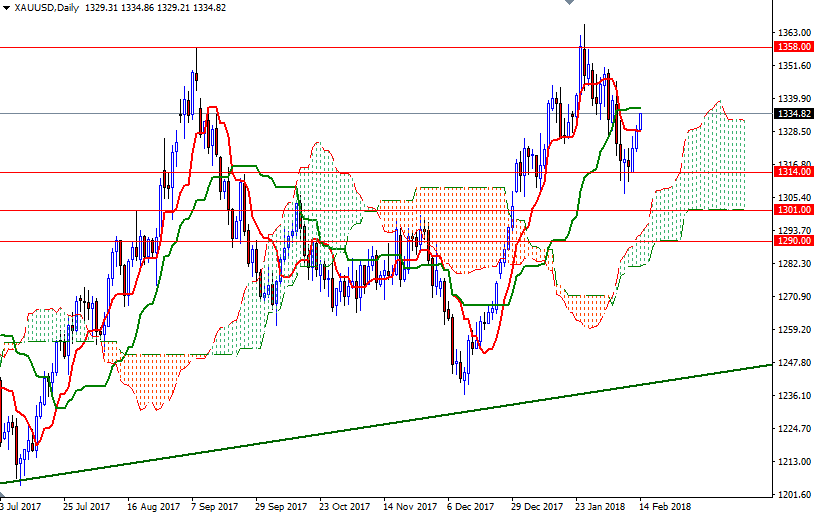

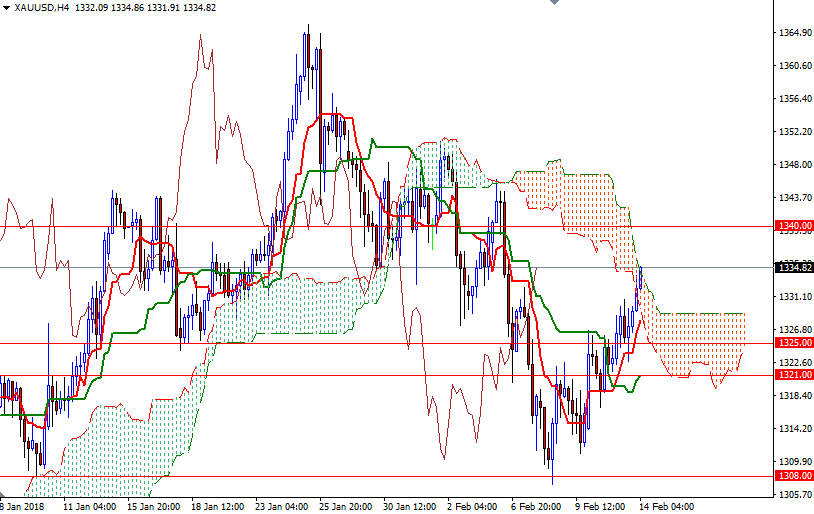

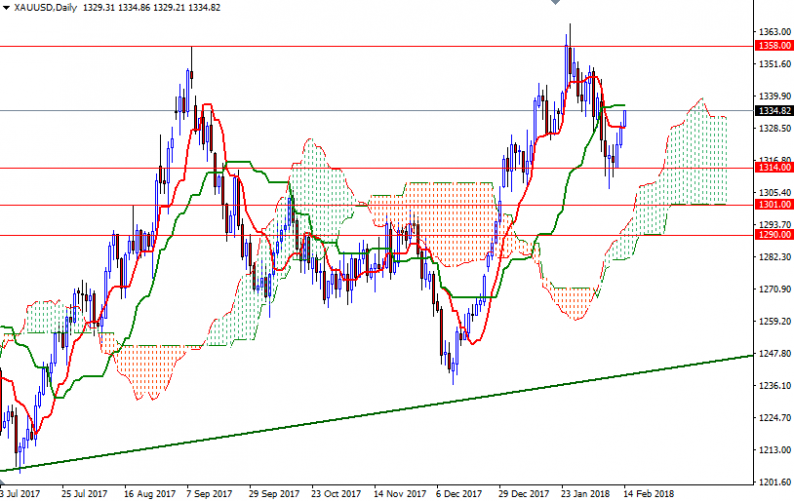

From a chart perspective, the bulls still have the long-term technical advantage, with the market trading above the weekly and the daily Ichimoku clouds. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the H4 and the H1 charts, along with Chikou Span/Price crosses in the same direction. If prices can stay above the 4-hourly cloud, a move towards 1342/0 seems possible. However, in order to reach there, the bulls have to push through 1336.45 (the daily Kijun-Sen). A break above 1342 implies that the 1347/5 area will be the next target.

To the downside, keep an eye on the 1329/8 area where the top of the 4-hourly cloud stands. If XAU/USD falls below 1328, the bears will be aiming for 1325 next. The bottom of the cloud sits at 1321 so the bears will have to drag the market below there to take the reins and make an assault on the support in the 1314/2 area.

Leave A Comment